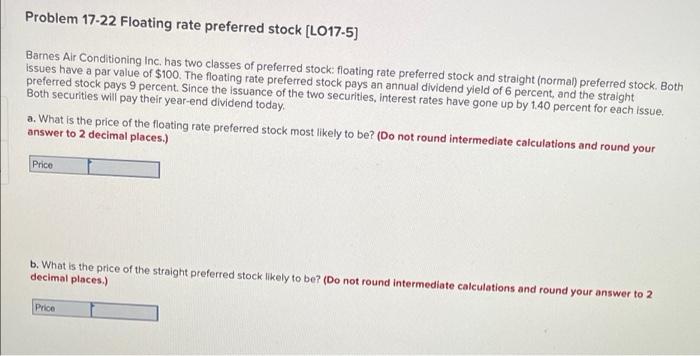

Question: Problem 17-22 Floating rate preferred stock (L017-5) Barnes Air Conditioning Inc. has two classes of preferred stock floating rate preferred stock and straight (normal) preferred

Problem 17-22 Floating rate preferred stock (L017-5) Barnes Air Conditioning Inc. has two classes of preferred stock floating rate preferred stock and straight (normal) preferred stock. Both Issues have a par value of $100. The floating rate preferred stock pays an annual dividend yield of 6 percent, and the straight preferred stock pays 9 percent. Since the issuance of the two securities, interest rates have gone up by 1.40 percent for each issue. Both securities will pay their year-end dividend today, a. What is the price of the floating rate preferred stock most likely to be? (Do not round intermediate calculations and round your answer to 2 decimal places.) Price b. What is the price of the straight preferred stock likely to be? (Do not round intermediate calculations and round your answer to 2 decimal places.) Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts