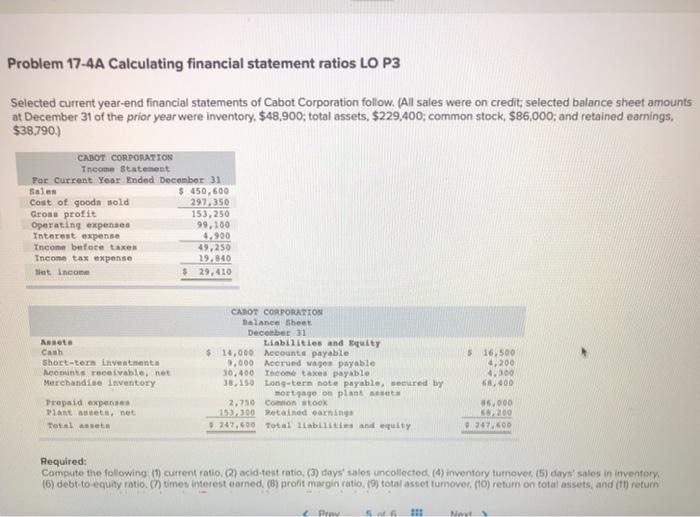

Question: Problem 17-4A Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet

Problem 17-4A Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $48,900 total assets, $229,400; common stock, $86,000, and retained earnings. $38,790.) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 450,600 Cost of goods sold 297.350 Gross profit 153,250 Operating expenses 99.100 Interest expense 4.900 Income before taxes 49,250 Income tax expense 19.340 et income $ 29,410 Aneta Canh Short-term investments heets receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 14,000 Accounts payable ,000 Acerved vagos payable 30.400 Income taxes payable 38,150 Long-term note payable, sured by mortgage on plant and 2,750 Coon stock 153.100 Retained earnings 5.247,600 Total liabilities and equity $16.500 4,200 4.300 68,00 Trepaid expenses Want to.net Totalt 86.000 200 347.500 Required: Compute the following (1) current ratio (2) acid-test ratio. (3) days' sales uncollected. (4) inventory turnover (5) days' sales in inventory, (6) debt-to-equity ratio (7) times interest earned, (B) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return 11 Nav

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts