Question: Problem 1-7A (Static) Analyzing transactions and preparing financial statements LO P1, P2 [The following information applies to the questions displayed below.] Gabi Gram started The

Problem 1-7A (Static) Analyzing transactions and preparing financial statements LO P1, P2

[The following information applies to the questions displayed below.] Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the following transactions during its first month of operations.

| May | 1 | G. Gram invested $40,000 cash in the company in exchange for its common stock. | ||

| 1 | The company rented a furnished office and paid $2,200 cash for Mays rent. | |||

| 3 | The company purchased $1,890 of equipment on credit. | |||

| 5 | The company paid $750 cash for this months cleaning services. | |||

| 8 | The company provided consulting services for a client and immediately collected $5,400 cash. | |||

| 12 | The company provided $2,500 of consulting services for a client on credit. | |||

| 15 | The company paid $750 cash for an assistants salary for the first half of this month. | |||

| 20 | The company received $2,500 cash payment for the services provided on May 12. | |||

| 22 | The company provided $3,200 of consulting services on credit. | |||

| 25 | The company received $3,200 cash payment for the services provided on May 22. | |||

| 26 | The company paid $1,890 cash for the equipment purchased on May 3. | |||

| 27 | The company purchased $80 of equipment on credit. | |||

| 28 | The company paid $750 cash for an assistants salary for the second half of this month. | |||

| 30 | The company paid $300 cash for this months telephone bill. | |||

| 30 | The company paid $280 cash for this months utilities. | |||

| 31 | The company paid $1,400 cash in dividends to the owner (sole shareholder). |

Q1:

Q2:

![[The following information applies to the questions displayed below.] Gabi Gram started](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e902ec321f7_66766e902ebc557e.jpg)

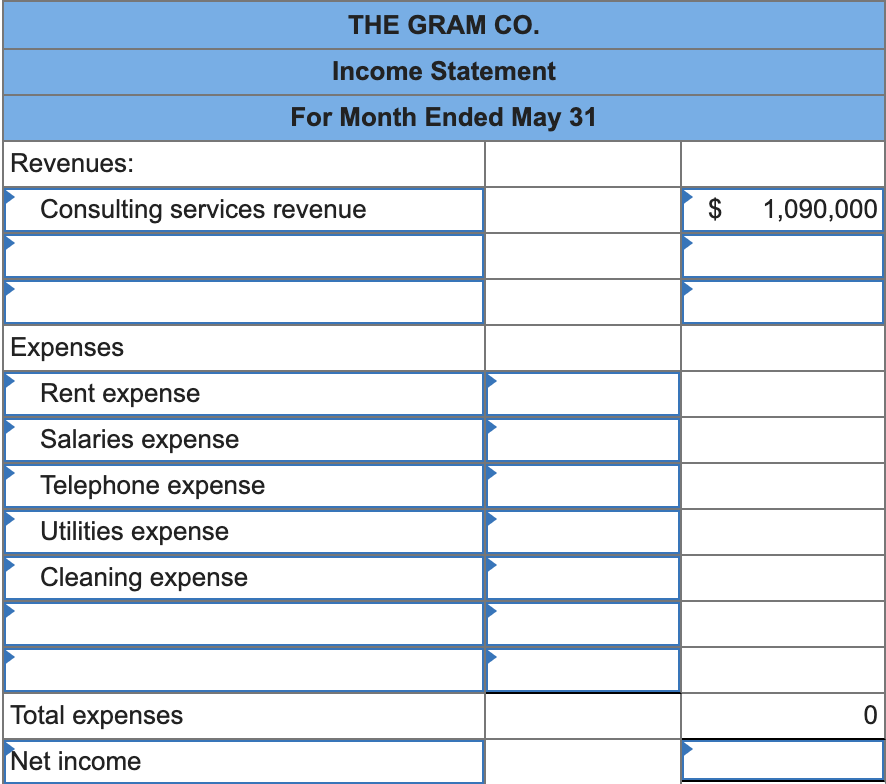

THE GRAM CO. Income Statement For Month Ended May 31 Revenues: Consulting services revenue $ 1,090,000 Expenses Rent expense Salaries expense Telephone expense Utilities expense Cleaning expense Total expenses 0 Net income THE GRAM CO. Statement of Retained Earnings For Month Ended May 31 Retained earnings, May 1 $ 0 Add: Net income 5,990 X 5,990 14,000 (8,010) Less: Dividends Retained earnings, May 31 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts