Question: Problem 1-8 Lanni Products is a start-up computer software development firm. It currently owns computer equipment worth $32,500 and has cash on hand of $15,000

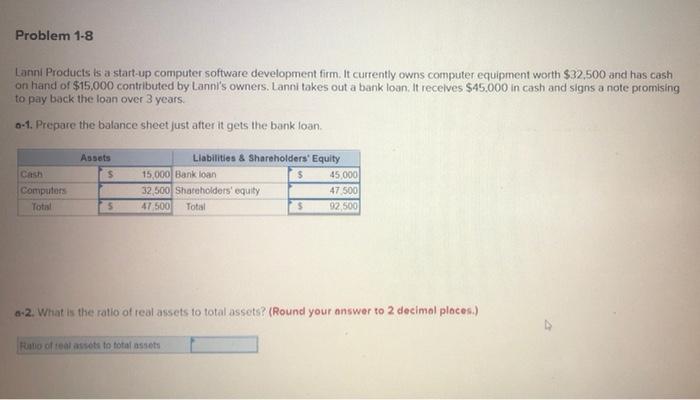

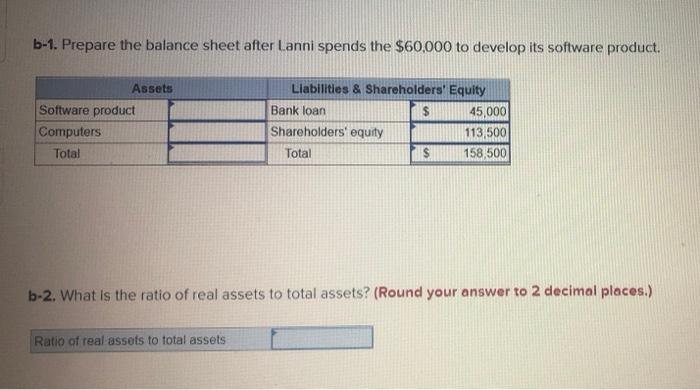

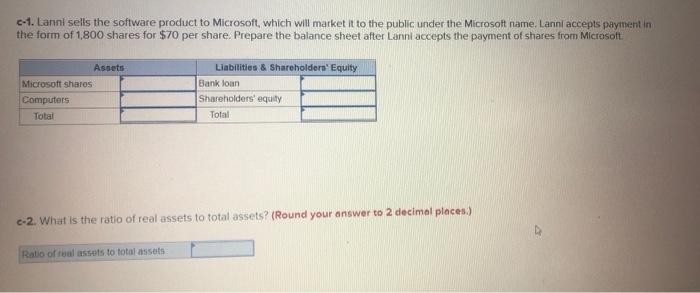

Problem 1-8 Lanni Products is a start-up computer software development firm. It currently owns computer equipment worth $32,500 and has cash on hand of $15,000 contributed by Lanni's owners. Lanol tokes out a bank loan. It receives $45,000 in cash and signs a note promising to pay back the loan over 3 years. 0-1. Prepare the balance sheet just after it gets the bank loan Assets $ Cash Computers Total Liabilities & Shareholders' Equity 15,000 Bank loan $ 45,000 32 500 Shareholders' equity 47 500 47 500 Total $ 92 500 5 3-2. What is the ratio of real assets to total assets? (Round your answer to 2 decimal places.) Foto oftalassots to total assets b-1. Prepare the balance sheet after Lanni spends the $60,000 to develop its software product. Assets Software product Computers Total Liabilities & Shareholders' Equity Bank loan $ 45,000 Shareholders' equity 113,500 Total $ 158,500 b-2. What is the ratio of real assets to total assets? (Round your answer to 2 decimal places.) Ratio of real assets to total assets 0-1. Lanni sells the software product to Microsoft, which will market it to the public under the Microsoft name, Lanni accepts payment in the form of 1,800 shares for $70 per share. Prepare the balance sheet after Lanni accepts the payment of shares from Microsoft Assets Microsoft shares Computers Total Liabilities & Shareholders' Equity Bank loan Shareholders' equity Total c-2. What is the ratio of real assets to total assets? (Round your answer to 2 decimal places) Ratio of real assets to total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts