Question: Problem 18) What is right statement for log return and simple return in the context of financial modeling A) There is really no difference between

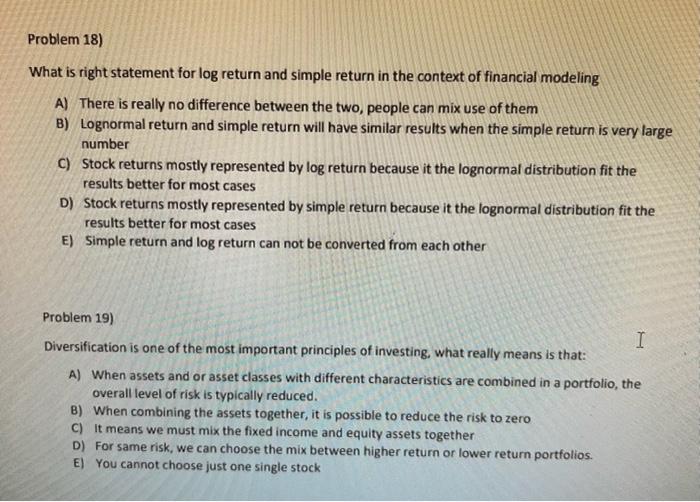

Problem 18) What is right statement for log return and simple return in the context of financial modeling A) There is really no difference between the two people can mix use of them B) Lognormal return and simple return will have similar results when the simple return is very large number C) Stock returns mostly represented by log return because it the lognormal distribution fit the results better for most cases D) Stock returns mostly represented by simple return because it the lognormal distribution fit the results better for most cases E) Simple return and log return can not be converted from each other I Problem 19) Diversification is one of the most important principles of investing, what really means is that: A) When assets and or asset classes with different characteristics are combined in a portfolio, the overall level of risk is typically reduced. B) When combining the assets together, it is possible to reduce the risk to zero C) It means we must mix the fixed income and equity assets together D) For same risk, we can choose the mix between higher return or lower return portfolios. E) You cannot choose just one single stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts