Question: Problem 18-02 Over the last five years, corporation A has been consistently profitable. Its earnings before taxes were as follows: Not Answered Year Taxes a.

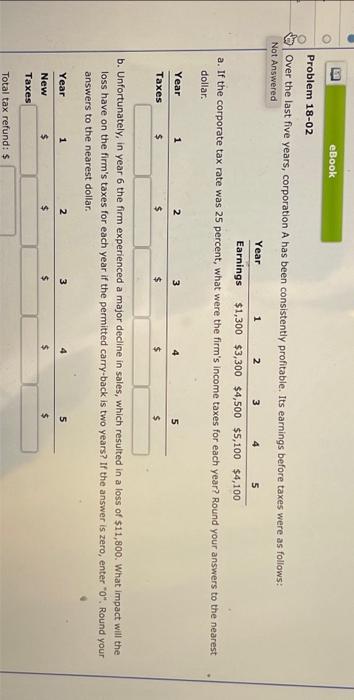

Problem 18-02 Over the last five years, corporation A has been consistently profitable. Its earnings before taxes were as follows: Not Answered Year Taxes a. If the corporate tax rate was 25 percent, what were the firm's income taxes for each year? Round your answers to the nearest dollar. 1 Year New Taxes $ eBook 1 $ 2 Total tax refund: $ Year 1 2 3 4 5 Earnings $1,300 $3,300 $4,500 $5,100 $4,100 2 $ b. Unfortunately, in year 6 the firm experienced a major decline in sales, which resulted in a loss of $11,800. What impact will the loss have on the firm's taxes for each year if the permitted carry-back is two years? If the answer is zero, enter "0". Round your answers to the nearest dollar. 3 $ 3 4 $ 5 4 $ 5 $

Over the last five years, corporation A has been consistently profitable. Its earnings before taxes were as follows: a. If the corporate tax rate was 25 percent, what were the firm's income taxes for each year? Round your answers to the nearest dollar. b. Unfortunately, in year 6 the firm experienced a major decline in sales, which resulted in a loss of $11,800. What impact will the loss have on the firm's taxes for each year if the permitted carry-back is two years? If the answer is zero, enter " 0 ". Round your answers to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock