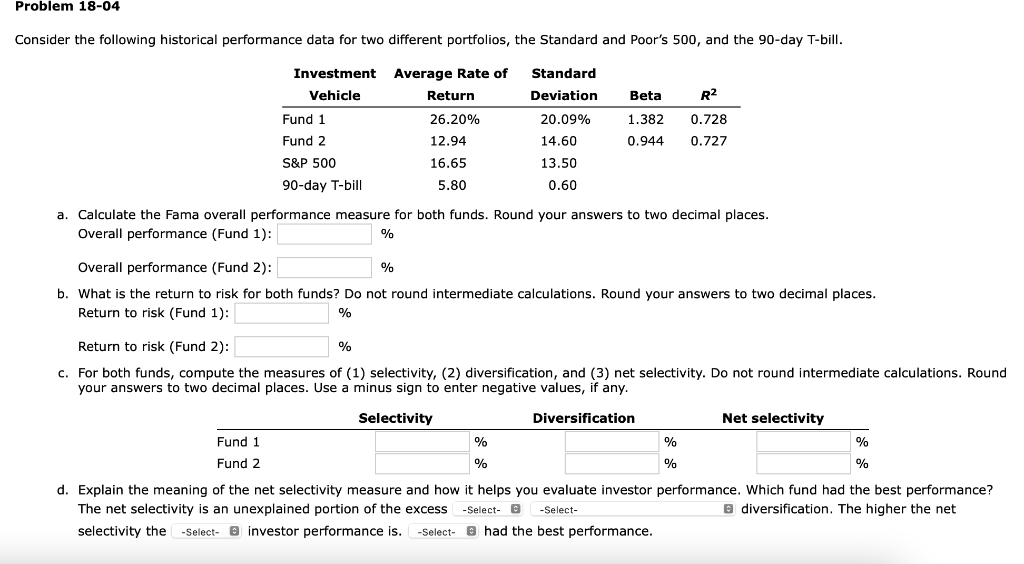

Question: Problem 18-04 Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama

Problem 18-04 Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): 0/0 b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. The net selectivity is an unexplained portion of the excess I diversification. The higher the net selectivity the investor performance is. had the best performance. Problem 18-04 Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): 0/0 b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. The net selectivity is an unexplained portion of the excess I diversification. The higher the net selectivity the investor performance is. had the best performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts