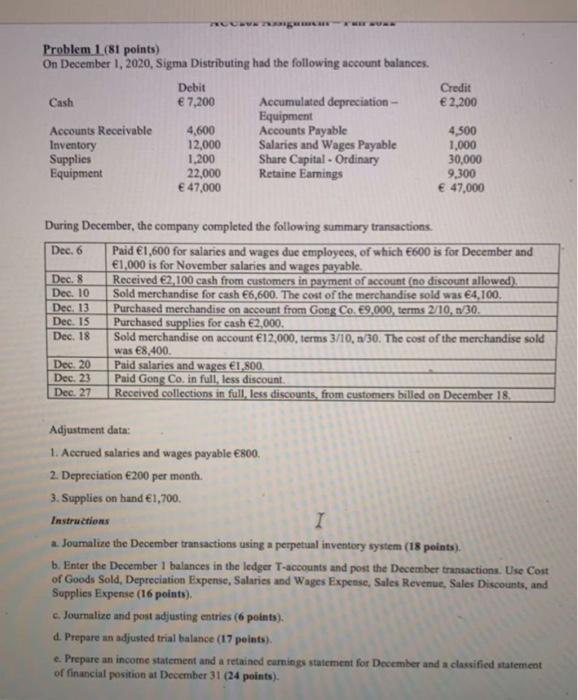

Question: Problem 1.(81 points) On December 1, 2020, Sigma Distributing had the following account balances. During December, the company completed the following summary transactions. Adjustment data:

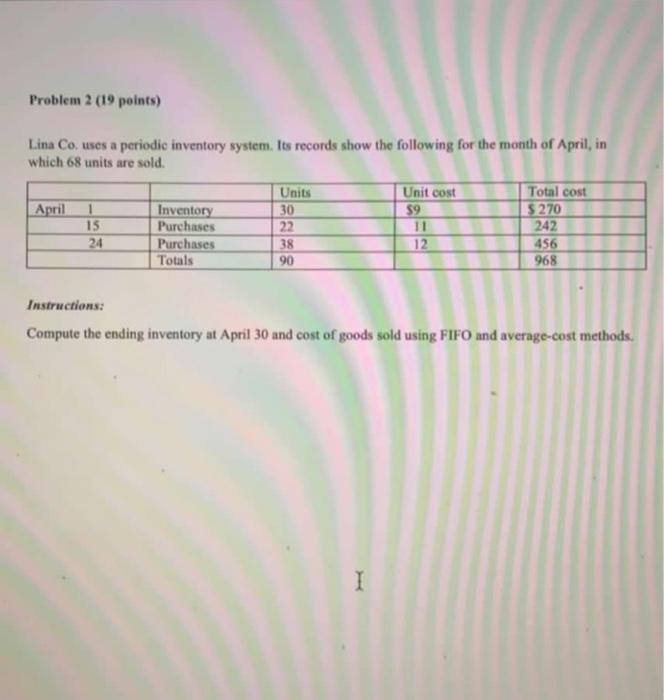

Problem 1.(81 points) On December 1, 2020, Sigma Distributing had the following account balances. During December, the company completed the following summary transactions. Adjustment data: 1. Accrued salaries and wages payable e800. 2. Depreciation 200 per month. 3. Supplies on hand 1,700. Instructions a. Joumalize the December transactions using a perpetual inventory system ( 18 peints). b. Enter the December 1 balances in the ledger T-accouats and post the December transactions. Use Cost of Goods Sold, Depreciation Expense, Salaries and Wages Expesse, Sales Revenue, Sales Discounts, and Supplies Expense ( 16 points). c. Journalize and post adjusting entries ( 6 points). d. Prepare an adjusted trial balance (17 peints). e. Prepare an income statement and a retained carniogs statement for December and a classified statement of financial position at December 31 (24 points). Lina Co. uses a periodic inventory system. Its records show the following for the month of April, in which 68 units are sold. Instructions: Compute the ending inventory at April 30 and cost of goods sold using FIFO and average-cost methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts