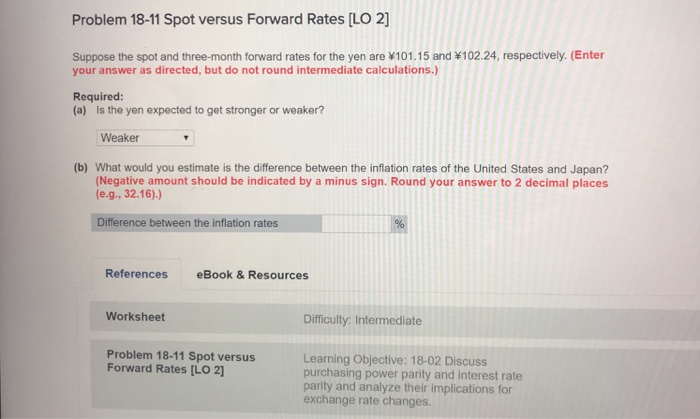

Question: Problem 18-11 Spot versus Forward Rates [LO 2 Suppose the spot and three-month forward rates for the yen are 101.15 and *102.24, respectively. (Enter your

Problem 18-11 Spot versus Forward Rates [LO 2 Suppose the spot and three-month forward rates for the yen are 101.15 and *102.24, respectively. (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) Is the yen expected to get stronger or weaker? Weaker (b) What would you estimate is the difference between the inflation rates of the United States and Japan? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places (e.g., 32.16)) Difference between the inflation rates References eBook &Resources Worksheet Difficulty: Intermediate Problem 18-11 Spot versus Forward Rates [LO 21 Learning Objective: 18-02 Discuss purchasing power parity and interest rate parity and analyze their implications for exchange rate changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts