Question: *Problem 18-11 Your answer is partially correct. Try again On July 1, 2017, Crane Construction Company Inc. contracted to build an office building for Gumbel

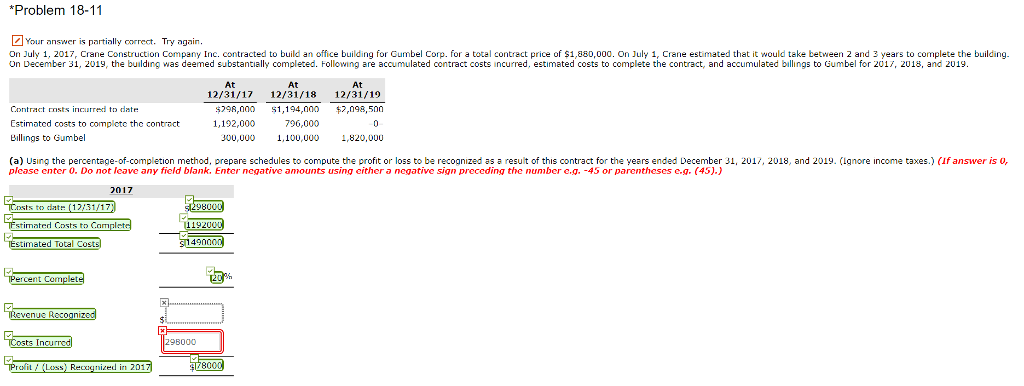

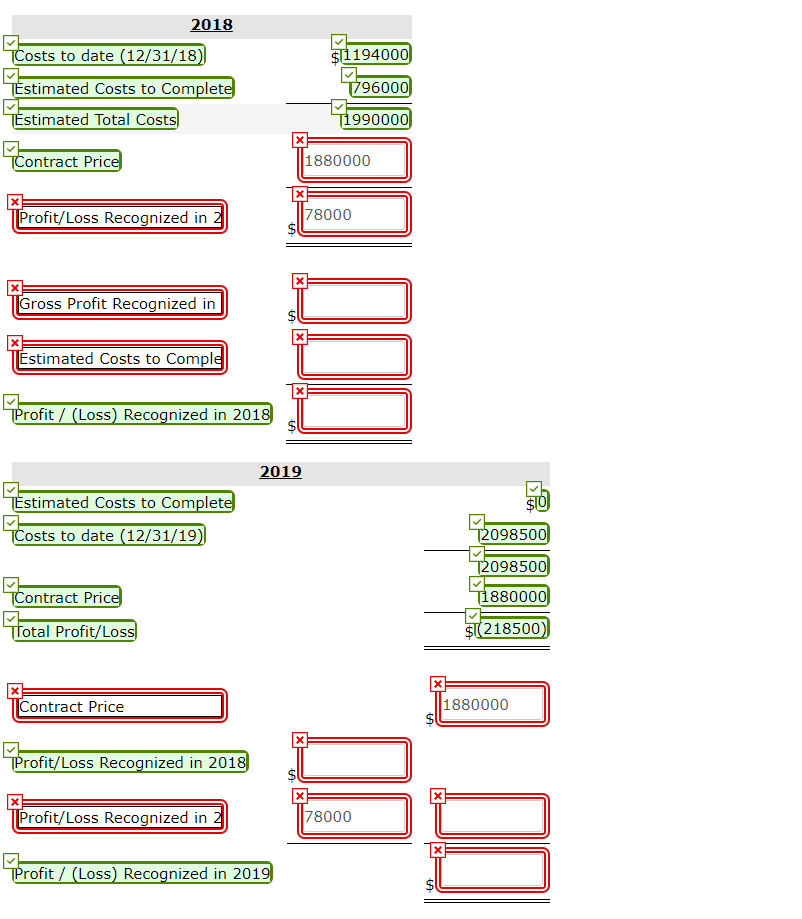

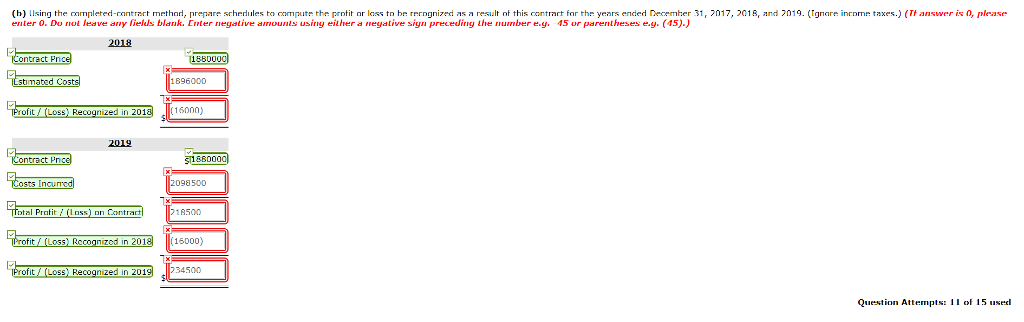

*Problem 18-11 Your answer is partially correct. Try again On July 1, 2017, Crane Construction Company Inc. contracted to build an office building for Gumbel Corp. for a total contract price of $1,880,000. On July 1, Crane estimated that it would take between 2 and 3 years to complete the building. On December 31, 2019, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2017, 2018, and 2019. At At At 12/31/17 12/31/18 12/31/19 $8,00051,194,000 $,098,500 Contract rsts incrd to date Estimated costs to complctc the controct Billings to Gumbel 1,192,000 796,000 300,U0O 1,10,00 1,820,000 (a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 201?, 2018, and 2019. (lgnore income taxes.) (If answer is 0, plcase enter 0. Do not leave any field blank. Enter negative amounts using cither a negative sign preceding the number e.g.-45 or parentheses c.g. (45).) 017 osts to ciate 1731/17 stimated Costs to Cn 49000 ercent Complet B000 Loss !)ized in 201

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts