Question: Problem 18.1A Determining the cost to be capitalized for acquisition of assets. LO 18-1 On January 6, 2019, Baxter Company purchased a site for a

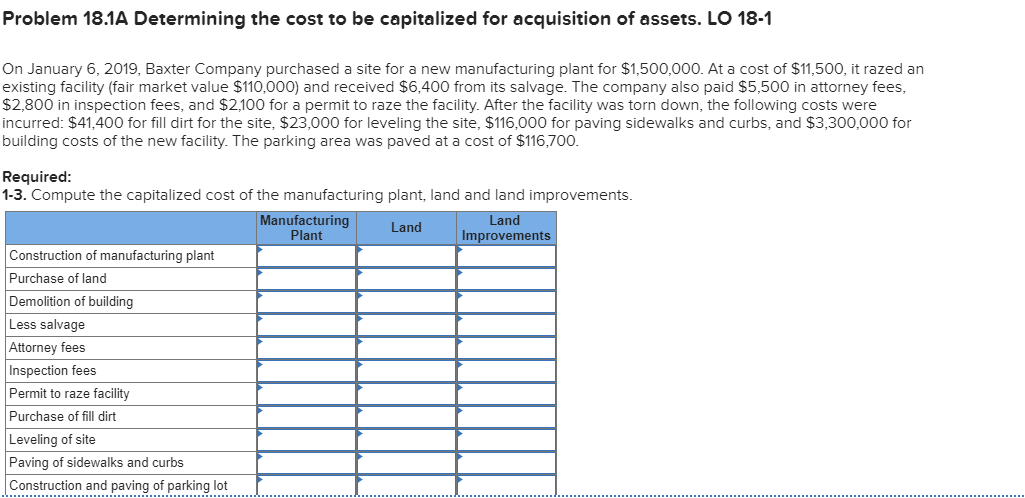

Problem 18.1A Determining the cost to be capitalized for acquisition of assets. LO 18-1 On January 6, 2019, Baxter Company purchased a site for a new manufacturing plant for $1,500,000. At a cost of $11,500, it razed an existing facility (fair market value $110,000) and received $6,400 from its salvage. The company also paid $5,500 in attorney fees, $2,800 in inspection fees, and $2,100 for a permit to raze the facility. After the facility was torn down, the following costs were incurred: $41,400 for fill dirt for the site, $23,000 for leveling the site, $116,000 for paving sidewalks and curbs, and $3,300,000 for building costs of the new facility. The parking area was paved at a cost of $116,700. Required: 1-3. Compute the capitalized cost of the manufacturing plant, land and land improvements. Manufacturing ing Land Land Plant Improvements Construction of manufacturing plant Purchase of land Demolition of building Less salvage Attorney fees Inspection fees Permit to raze facility Purchase of fill dirt Leveling of site Paving of sidewalks and curbs Construction and paving of parking lot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts