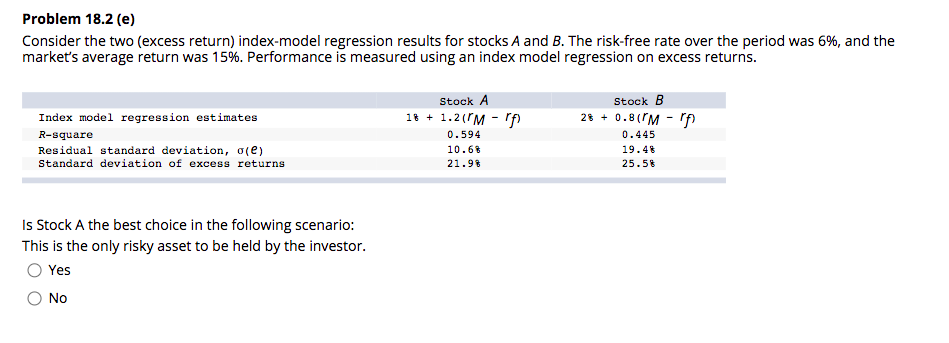

Question: Problem 18.2 (e) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and

Problem 18.2 (e) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Stock B Stock A 10 + 1.25M - rf Index model regression estimates 28 + 0.81M - rf 0.594 0.445 R-square Residual standard deviation, ole) Standard deviation of excess returns 10.66 19.4% 21.98 25.58 Is Stock A the best choice in the following scenario: This is the only risky asset to be held by the investor. Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts