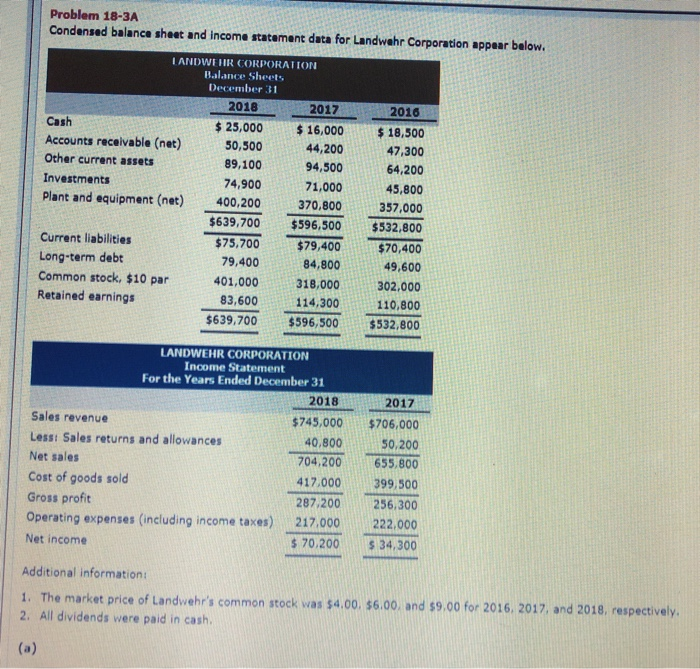

Question: Problem 18-3A Condensed balance sheet and income statement data for Landwahr Corporation appear below. LANDV HR CORI)ORAI ION Balance Sheets December 31 2016 $25,000$16,000 18,500

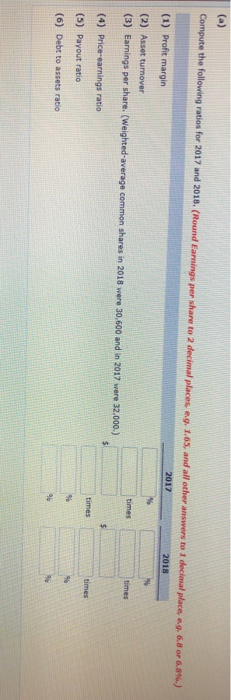

Problem 18-3A Condensed balance sheet and income statement data for Landwahr Corporation appear below. LANDV HR CORI)ORAI ION Balance Sheets December 31 2016 $25,000$16,000 18,500 Accounts receivable (net) 50,500 44,20047,300 64.200 45,800 Plant and equipment (net) 400.200 370.800 357.000 $639,700$596,500 $532.800 $75,700$79,400 $70,400 49,600 318,000 302.00o 110,800 $639,700$596,500 $532.800 2018 2017 Cash Other current assets 89,100 74,900 94,500 71,000 Investments Current liabilities Long-term debt Common stock, $10 par Retained earnings 79,400 401,000 83,600 84,800 114,300 LANDWEHR CORPORATION Income Statement For the Years Ended December 31 2017 $745,000$706,000 40.800 50.200 2018 Sales revenue Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) Net income 704,200 655,800 417,000399,500 287,200256 366 222.000 $ 70.20034,300 217.000 Additional information , $6.00, and s9.00 for 2016. 2017, and 2018, respectively 1. The market price of Landwehr's common stock was $4.00 2. All dividends were paid in cash. Computethe fo owing ratios for 2017 and 2018 (Round Earnings per share to 2 decimal places, e.g. 1.6s, and all other answers to 1 decimal place, eg 68 or&8% ) 2017 2018 (1) Profit margin (2) Asset turnover (3) Earnings per share. (Weighted-average common shares in 2018 were 30.600 and in 2017 were 32.000.) times times (5) Payout ratio (6) Debt to assets ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts