Question: Problem 18-6 Convertible Bonds (LO3, CFA5) A convertible bond has a coupon of 7.5 percent, paid semiannually, and will mature in 10 years. If the

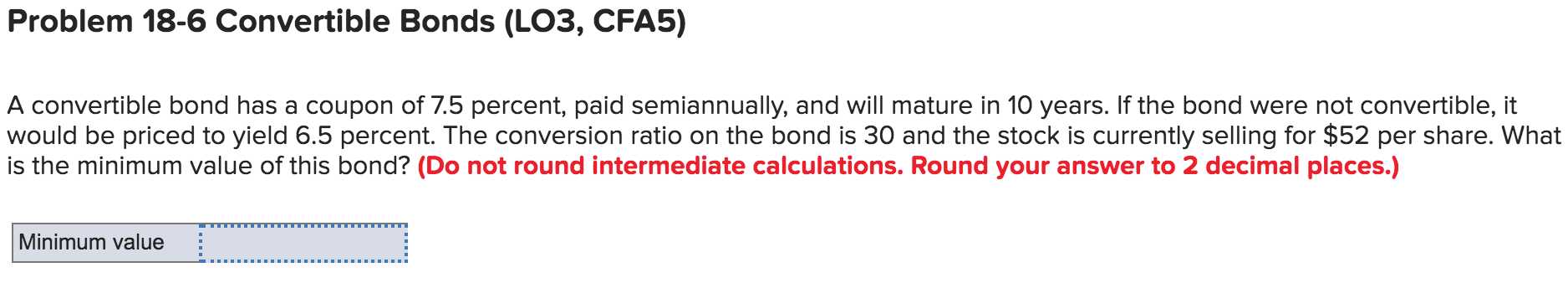

Problem 18-6 Convertible Bonds (LO3, CFA5) A convertible bond has a coupon of 7.5 percent, paid semiannually, and will mature in 10 years. If the bond were not convertible, it would be priced to yield 6.5 percent. The conversion ratio on the bond is 30 and the stock is currently selling for $52 per share. What is the minimum value of this bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Minimum value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock