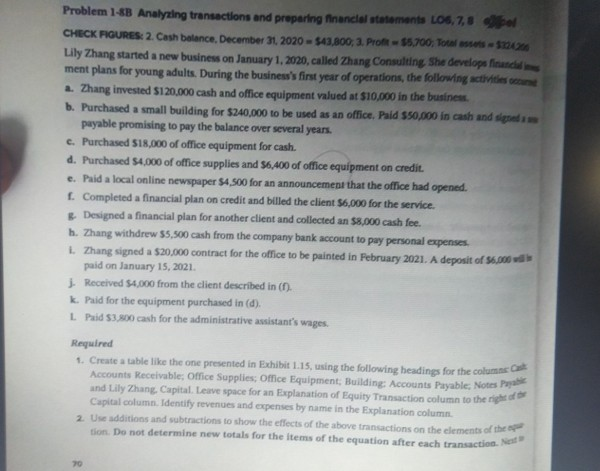

Question: Problem 1-8B Analyzing transactions and preparing financial statements LO6, 7, 8 bel CHECK FIGURES 2. Cash balance December 31, 2020 - $43,800, 3. Pront-$5.700 Total

Problem 1-8B Analyzing transactions and preparing financial statements LO6, 7, 8 bel CHECK FIGURES 2. Cash balance December 31, 2020 - $43,800, 3. Pront-$5.700 Total 10 Lily Zhang started a new business on January 1, 2020, called Zhang Consulting She developa financial ment plans for young adults. During the business's first year of operations, the following activities and 2. Zhang invested $120.000 cash and office equipment valued at $10,000 in the business. b. Purchased a small building for $240,000 to be used as an office. Pald $50,000 in cash and signed payable promising to pay the balance over several years. c. Purchased 518,000 of office equipment for cash. d. Purchased 54,000 of office supplies and 56,400 of office equipment on credit. e. Paid a local online newspaper 54,500 for an announcement that the office had opened. Completed a financial plan on credit and billed the client $6,000 for the service. Designed a financial plan for another client and collected an $8,000 cash fee. h. Zhang withdrew $5,500 cash from the company bank account to pay personal expenses. L. Zhang signed a $20.000 contract for the office to be painted in February 2021. A deposit of 56,00 paid on January 15, 2021 J Received 54,000 from the client described in (1) k. Paid for the equipment purchased in (d). L Paid 53.800 cash for the administrative assistant's wages. Required 1. Create a table like the one presented in Exhibit 1.15, using the following headings for the columns Accounts Receivable, Office Supplies: Office Equipment Building Accounts Payable, Notes Park and Lily Zhang, Capital. Leave space for an Explanation of Equity Transaction column to the right to Capital column. Identify revenues and expenses by name in the Explanation column 2. Use additions and subtractions to show the effects of the above transactions on the elements of the tion. Do not determine now totals for the items of the equation after each transaction." Problem 1-8B Analyzing transactions and preparing financial statements LO6, 7, 8 bel CHECK FIGURES 2. Cash balance December 31, 2020 - $43,800, 3. Pront-$5.700 Total 10 Lily Zhang started a new business on January 1, 2020, called Zhang Consulting She developa financial ment plans for young adults. During the business's first year of operations, the following activities and 2. Zhang invested $120.000 cash and office equipment valued at $10,000 in the business. b. Purchased a small building for $240,000 to be used as an office. Pald $50,000 in cash and signed payable promising to pay the balance over several years. c. Purchased 518,000 of office equipment for cash. d. Purchased 54,000 of office supplies and 56,400 of office equipment on credit. e. Paid a local online newspaper 54,500 for an announcement that the office had opened. Completed a financial plan on credit and billed the client $6,000 for the service. Designed a financial plan for another client and collected an $8,000 cash fee. h. Zhang withdrew $5,500 cash from the company bank account to pay personal expenses. L. Zhang signed a $20.000 contract for the office to be painted in February 2021. A deposit of 56,00 paid on January 15, 2021 J Received 54,000 from the client described in (1) k. Paid for the equipment purchased in (d). L Paid 53.800 cash for the administrative assistant's wages. Required 1. Create a table like the one presented in Exhibit 1.15, using the following headings for the columns Accounts Receivable, Office Supplies: Office Equipment Building Accounts Payable, Notes Park and Lily Zhang, Capital. Leave space for an Explanation of Equity Transaction column to the right to Capital column. Identify revenues and expenses by name in the Explanation column 2. Use additions and subtractions to show the effects of the above transactions on the elements of the tion. Do not determine now totals for the items of the equation after each transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts