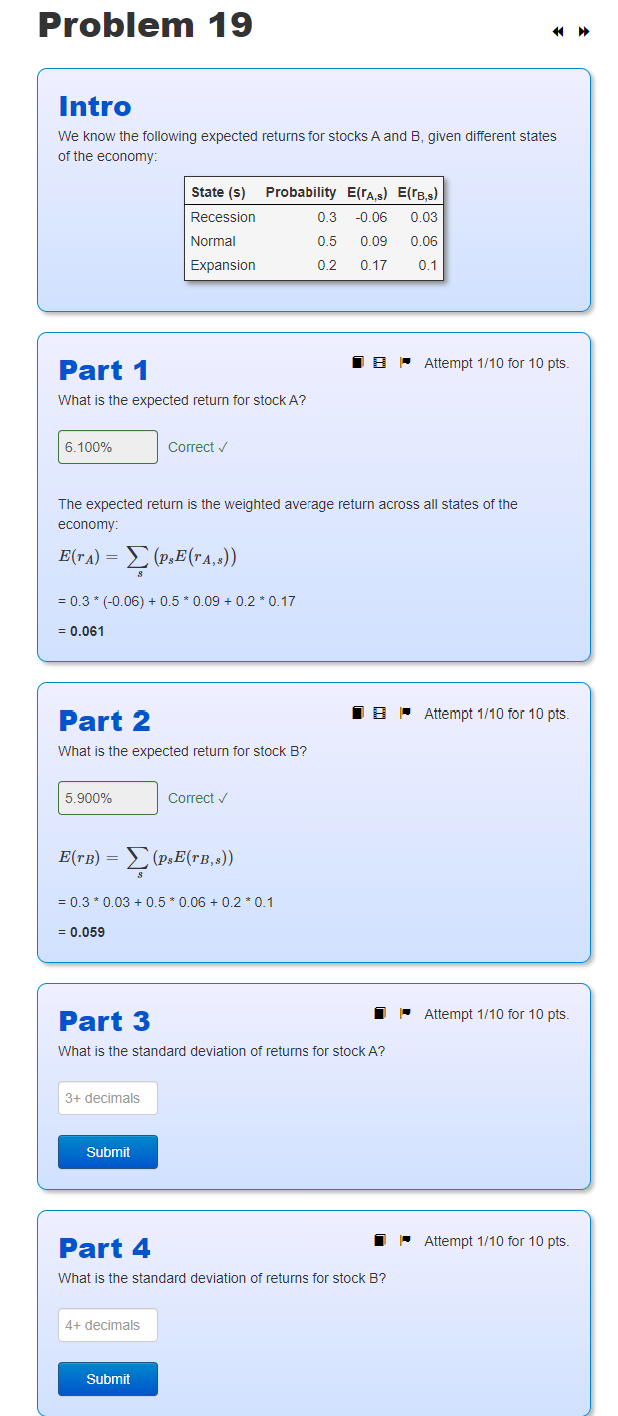

Question: Problem 19 Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(TA,s) E(TB,s)

Problem 19 Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(TA,s) E(TB,s) Recession 0.3 -0.06 0.03 Normal 0.5 0.09 0.06 Expansion 0.2 0.17 0.1 BAttempt 1/10 for 10 pts. Part 1 What is the expected return for stock A? 6.100% Correct The expected return is the weighted average return across all states of the economy: E(TA) = (PsE(TA,s)) = 0.3 * (-0.06) + 0.5 * 0.09 + 0.2 * 0.17 = 0.061 Part 2 What is the expected return for stock B? 5.900% Correct E(TB) = (psE(rB,s)) = 0.3 * 0.03 +0.5 * 0.06 +0.2 * 0.1 = 0.059 Part 3 What is the standard deviation of returns for stock A? 3+ decimals Submit Part 4 What is the standard deviation of returns for stock B? 4+ decimals Submit BAttempt 1/10 for 10 pts. Attempt 1/10 for 10 pts. Attempt 1/10 for 10 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts