Question: Problem 19-12 Short-Term Financing Plan (L03) Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter which has

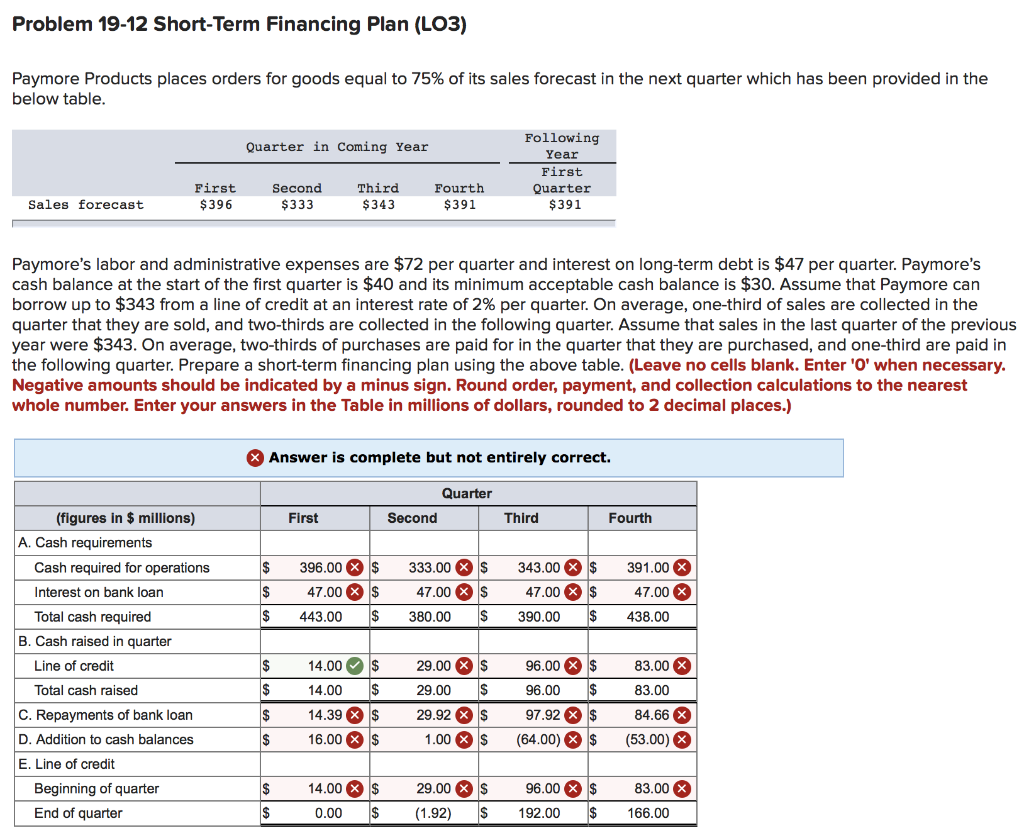

Problem 19-12 Short-Term Financing Plan (L03) Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter which has been provided in the below table. Quarter in Coming Year Following Year First Quarter $391 First $396 Second $333 Third $343 Fourth $391 Sales forecast Paymore's labor and administrative expenses are $72 per quarter and interest on long-term debt is $47 per quarter. Paymore's cash balance at the start of the first quarter is $40 and its minimum acceptable cash balance is $30. Assume that Paymore can borrow up to $343 from a line of credit at an interest rate of 2% per quarter. On average, one-third of sales are collected in the quarter that they are sold, and two-thirds are collected in the following quarter. Assume that sales in the last quarter of the previous year were $343. On average, two-thirds of purchases are paid for in the quarter that they are purchased, and one-third are paid in the following quarter. Prepare a short-term financing plan using the above table. (Leave no cells blank. Enter 'O' when necessary. Negative amounts should be indicated by a minus sign. Round order, payment, and collection calculations to the nearest whole number. Enter your answers in the Table in millions of dollars, rounded to 2 decimal places.) Answer is complete but not entirely correct. Quarter First Second Third Fourth $ 396.00 X $ 333.00 x $ 343.00 X $ 391.00 x (figures in $ millions) A. Cash requirements Cash required for operations Interest on bank loan Total cash required B. Cash raised in quarter Line of credit $ 47.00 $ 47.00 $ 47.00 X 47.00 X $ 443.00 $ $ 380.00 $ 390.00 $ 438.00 $ 14.00 $ 96.00 X $ 29.00 XS 29.00 $ 83.00 X 83.00 $ 14.00 $ 96.00 $ $ 14.39 x $ 29.92 XS 97.92 X $ 84.66 X 8 $ 16.00 $ 1.00 $ (64.00) $ (53.00) Total cash raised C. Repayments of bank loan D. Addition to cash balances E. Line of credit Beginning of quarter End of quarter $ 96.00 14.00 X $ 0.00 $ 29.00 $ (1.92) $ $ $ 83.00 X 166.00 $ 192.00 Problem 19-12 Short-Term Financing Plan (L03) Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter which has been provided in the below table. Quarter in Coming Year Following Year First Quarter $391 First $396 Second $333 Third $343 Fourth $391 Sales forecast Paymore's labor and administrative expenses are $72 per quarter and interest on long-term debt is $47 per quarter. Paymore's cash balance at the start of the first quarter is $40 and its minimum acceptable cash balance is $30. Assume that Paymore can borrow up to $343 from a line of credit at an interest rate of 2% per quarter. On average, one-third of sales are collected in the quarter that they are sold, and two-thirds are collected in the following quarter. Assume that sales in the last quarter of the previous year were $343. On average, two-thirds of purchases are paid for in the quarter that they are purchased, and one-third are paid in the following quarter. Prepare a short-term financing plan using the above table. (Leave no cells blank. Enter 'O' when necessary. Negative amounts should be indicated by a minus sign. Round order, payment, and collection calculations to the nearest whole number. Enter your answers in the Table in millions of dollars, rounded to 2 decimal places.) Answer is complete but not entirely correct. Quarter First Second Third Fourth $ 396.00 X $ 333.00 x $ 343.00 X $ 391.00 x (figures in $ millions) A. Cash requirements Cash required for operations Interest on bank loan Total cash required B. Cash raised in quarter Line of credit $ 47.00 $ 47.00 $ 47.00 X 47.00 X $ 443.00 $ $ 380.00 $ 390.00 $ 438.00 $ 14.00 $ 96.00 X $ 29.00 XS 29.00 $ 83.00 X 83.00 $ 14.00 $ 96.00 $ $ 14.39 x $ 29.92 XS 97.92 X $ 84.66 X 8 $ 16.00 $ 1.00 $ (64.00) $ (53.00) Total cash raised C. Repayments of bank loan D. Addition to cash balances E. Line of credit Beginning of quarter End of quarter $ 96.00 14.00 X $ 0.00 $ 29.00 $ (1.92) $ $ $ 83.00 X 166.00 $ 192.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts