Question: Problem 19-29 (Algorithmic) (LO. 3) At her death, Chow owned 55% of the stock in Finch Corporation, with the balance held by family members.

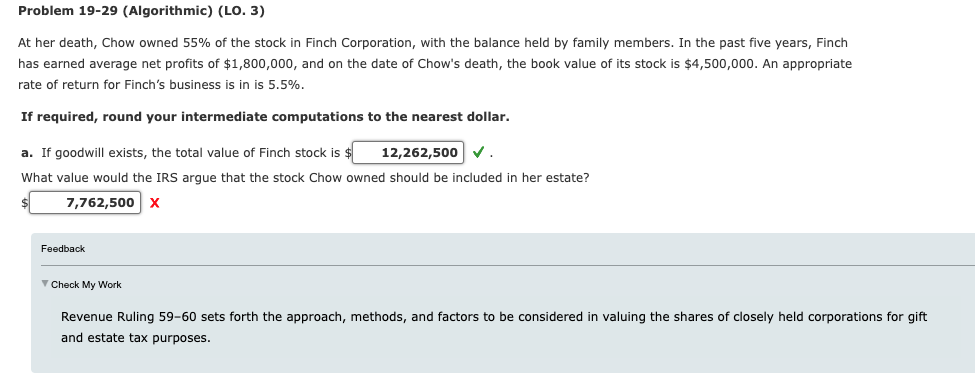

Problem 19-29 (Algorithmic) (LO. 3) At her death, Chow owned 55% of the stock in Finch Corporation, with the balance held by family members. In the past five years, Finch has earned average net profits of $1,800,000, and on the date of Chow's death, the book value of its stock is $4,500,000. An appropriate rate of return for Finch's business is in is 5.5%. If required, round your intermediate computations to the nearest dollar. a. If goodwill exists, the total value of Finch stock is $ 12,262,500 . What value would the IRS argue that the stock Chow owned should be included in her estate? 7,762,500 X Feedback Check My Work Revenue Ruling 59-60 sets forth the approach, methods, and factors to be considered in valuing the shares of closely held corporations for gift and estate tax purposes.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts