Question: Problem 19-33 (LO. 4, 5, 6) Janet, age 29, is unmarried and is an active participant in a qualified retirement plan. Her modified AGI is

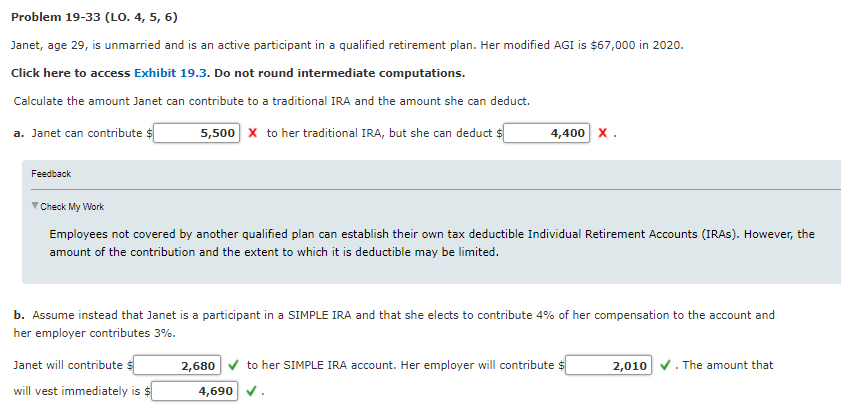

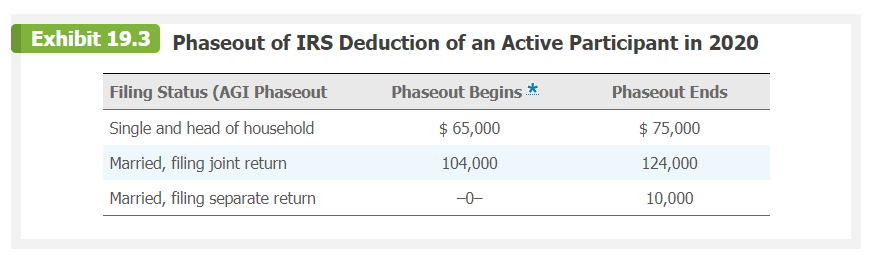

Problem 19-33 (LO. 4, 5, 6) Janet, age 29, is unmarried and is an active participant in a qualified retirement plan. Her modified AGI is $67,000 in 2020. Click here to access Exhibit 19.3. Do not round intermediate computations. Calculate the amount Janet can contribute to a traditional IRA and the amount she can deduct. a. Janet can contribute $ 5,500 X to her traditional IRA, but she can deduct $ 4,400 x Feedback Check My Work Employees not covered by another qualified plan can establish their own tax deductible Individual Retirement Accounts (IRAS). However, the amount of the contribution and the extent to which it is deductible may be limited. b. Assume instead that Janet is a participant in a SIMPLE IRA and that she elects to contribute 4% of her compensation to the account and her employer contributes 3%. 2,010. The amount that Janet will contribute s will vest immediately is $ 2,680 to her SIMPLE IRA account. Her employer will contribute $ 4,690. Exhibit 19.3 Phaseout of IRS Deduction of an Active Participant in 2020 Phaseout Begins * $ 65,000 Phaseout Ends $ 75,000 Filing Status (AGI Phaseout Single and head of household Married, filing joint return Married, filing separate return 104,000 124,000 -0- 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts