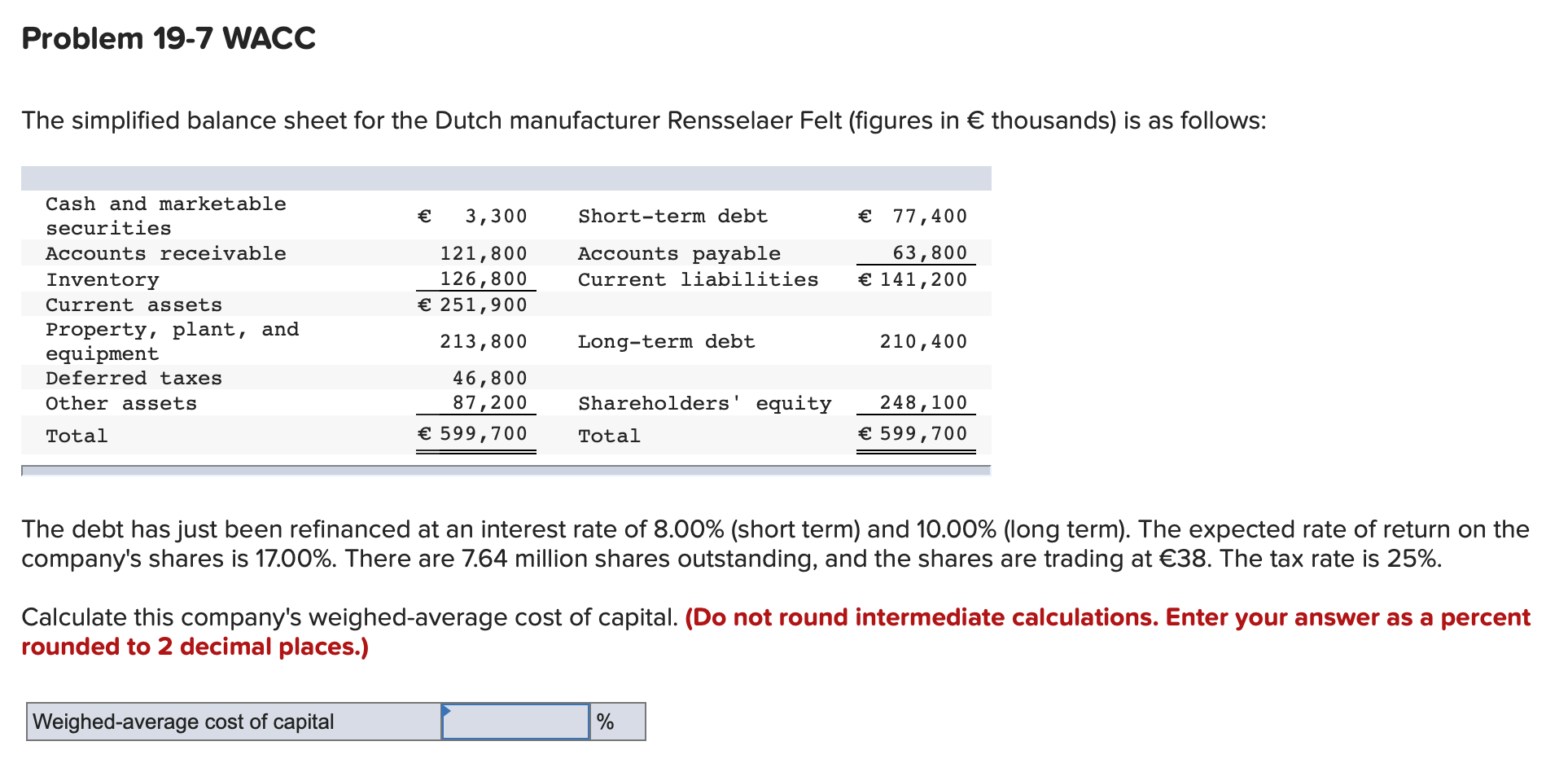

Question: Problem 19-7 WACC The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in thousands) is as follows: Short-term debt 77,400 Accounts payable Current

Problem 19-7 WACC The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in thousands) is as follows: Short-term debt 77,400 Accounts payable Current liabilities 63,800 141,200 Cash and marketable securities Accounts receivable Inventory Current assets Property, plant, and equipment Deferred taxes Other assets 3,300 121,800 126,800 251,900 213,800 46,800 87,200 599,700 Long-term debt 210,400 Shareholders' equity Total 248,100 599,700 Total The debt has just been refinanced at an interest rate of 8.00% (short term) and 10.00% (long term). The expected rate of return on the company's shares is 17.00%. There are 7.64 million shares outstanding, and the shares are trading at 38. The tax rate is 25%. Calculate this company's weighed-average cost of capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighed-average cost of capital %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts