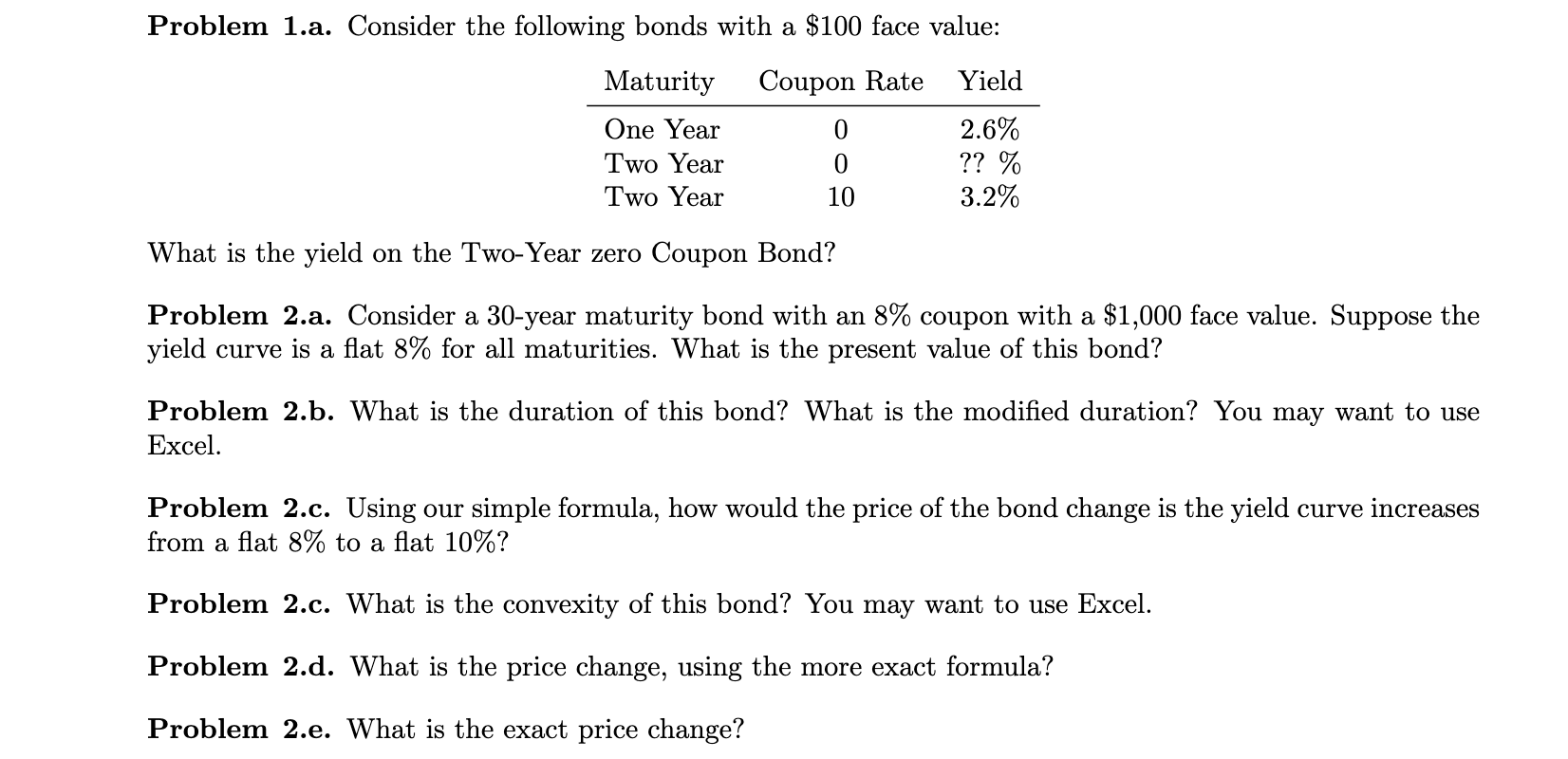

Question: Problem 1.a. Consider the following bonds with a $100 face value: Coupon Rate Yield Maturity One Year Two Year Two Year 0 0 10 2.6%

Problem 1.a. Consider the following bonds with a $100 face value: Coupon Rate Yield Maturity One Year Two Year Two Year 0 0 10 2.6% ?? % 3.2% What is the yield on the Two-Year zero Coupon Bond? Problem 2.a. Consider a 30-year maturity bond with an 8% coupon with a $1,000 face value. Suppose the yield curve is a flat 8% for all maturities. What is the present value of this bond? Problem 2.b. What is the duration of this bond? What is the modified duration? You may want to use Excel. Problem 2.c. Using our simple formula, how would the price of the bond change is the yield curve increases from a flat 8% to a flat 10%? Problem 2.c. What is the convexity of this bond? You may want to use Excel. Problem 2.d. What is the price change, using the more exact formula? Problem 2.e. What is the exact price change? Problem 1.a. Consider the following bonds with a $100 face value: Coupon Rate Yield Maturity One Year Two Year Two Year 0 0 10 2.6% ?? % 3.2% What is the yield on the Two-Year zero Coupon Bond? Problem 2.a. Consider a 30-year maturity bond with an 8% coupon with a $1,000 face value. Suppose the yield curve is a flat 8% for all maturities. What is the present value of this bond? Problem 2.b. What is the duration of this bond? What is the modified duration? You may want to use Excel. Problem 2.c. Using our simple formula, how would the price of the bond change is the yield curve increases from a flat 8% to a flat 10%? Problem 2.c. What is the convexity of this bond? You may want to use Excel. Problem 2.d. What is the price change, using the more exact formula? Problem 2.e. What is the exact price change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts