Question: Problem 1(Interpreting Regression Results) 20 Points On the next page, you will find two sets of regressions for estimating Beta in the CAPM model. Both

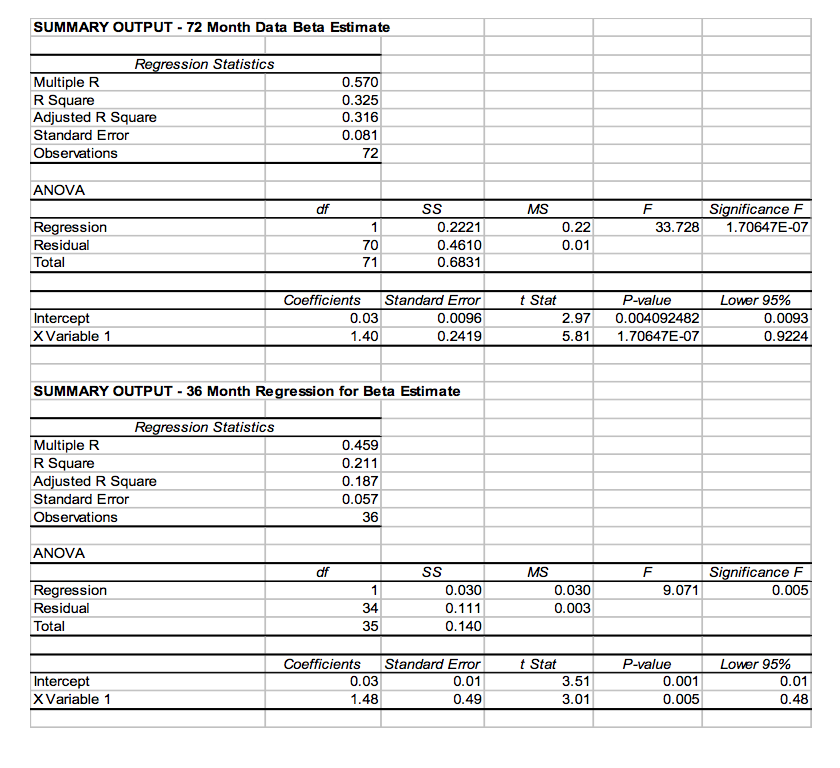

Problem 1(Interpreting Regression Results) 20 Points On the next page, you will find two sets of regressions for estimating Beta in the CAPM model. Both are based upon the result using the 20 Year Treasury Bill as the relevant risk free rate and the S&P500 as the proxy for the market return. Based on the best regression, below, identify the estimated Beta and the appropriate degree of explanatory power. Assume the Market Risk Premium is 7% and the appropriate Risk-Free Rate is 3.2% 1. What is the appropriate Beta Estimate to use for CAPM-based Cost of equity estimates? Next, identify how much of the firm's return volatility is explained by the systematic risk component. Base your results on the best performing appropriate regression model. Beta Estimate Systematic Risk as percentage of Total Return Risk: 2. Compute the estimated cost of equity using the Single-Factor CAPM model. 3. Assume the Market Capitalization of the firm is $1.8 Billion Dollars. Use the Size Decile-Based Risk Premium information provided in the following table (page after regression results) to estimate the cost of equity using our "two factor" model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts