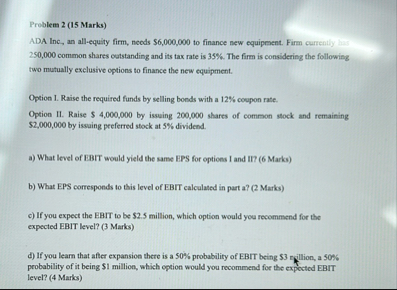

Question: Problem 2 ( 1 5 Marks ) ADA lnc , an all - equity firm, needs $ 6 , 0 0 0 , 0 0

Problem Marks

ADA lnc an allequity firm, needs $ to finance new equipenent. Firm currently ban common shares cetstanding and its tax rate is The firm is considering the following two mutually exclusive options to finance the new equipment.

Option I. Raise the required funds by selling bonds with a coupon rate.

Option II Raise $ by isswing shares of common stock and remaining $ by issaing preferred stock at dividend.

a What level of EBIT would yield the same PRS for options I and II Marks

b What EPS corresponds to this level of EBIT calculated in part a Marks

c If you expect the EBIT to be $ million, which option would you recommend for the expected EBIT level? Marks

d If you learn that after expansion there is a probability of EBIT being $ reillion, a probability of it being $ million, which option would you recommend for the expocted EBIT level? Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock