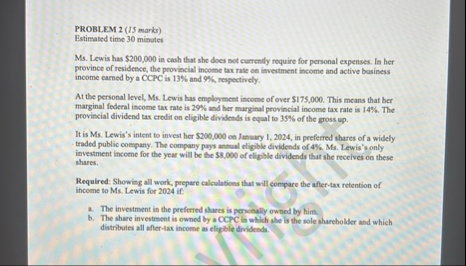

Question: PROBLEM 2 ( 1 5 marks ) Estimated time 3 0 minutes Ms . Lewis has $ 2 0 0 , 0 0 0 in

PROBLEM marks

Estimated time minutes

Ms Lewis has $ in cash that she does not currendy require for personal expenses. In her province of residesce, the provincial income tax rate oe irvestment income and active business income carned by a CCPC is and respectively.

At the personal level, Ms Lewis has employment income of over $ This means that her marginal federal income tax rate is and her murginal provincial income tax rate is The provincial dividend tax crodit on eligible dividends is equal to of the gross up

It is Ms Lewis's intent to invest her $ oe January in peeferred shares of a widely traded public company. The company pays antual eligible dividends of Ms Lewis's only investment income for the year will be the $ of eligille dividends that she receives on these shares.

Required: Showing all work, prepare calculations that will compare the aftertax retention of income to Ms Lewis for if:

a The investment in the preferred shares is pervonally owned by hims.

b The share investrsent is owned by a CCPC is which she is the sole shareholder and which distributes all aftertax income as elighle dividends.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock