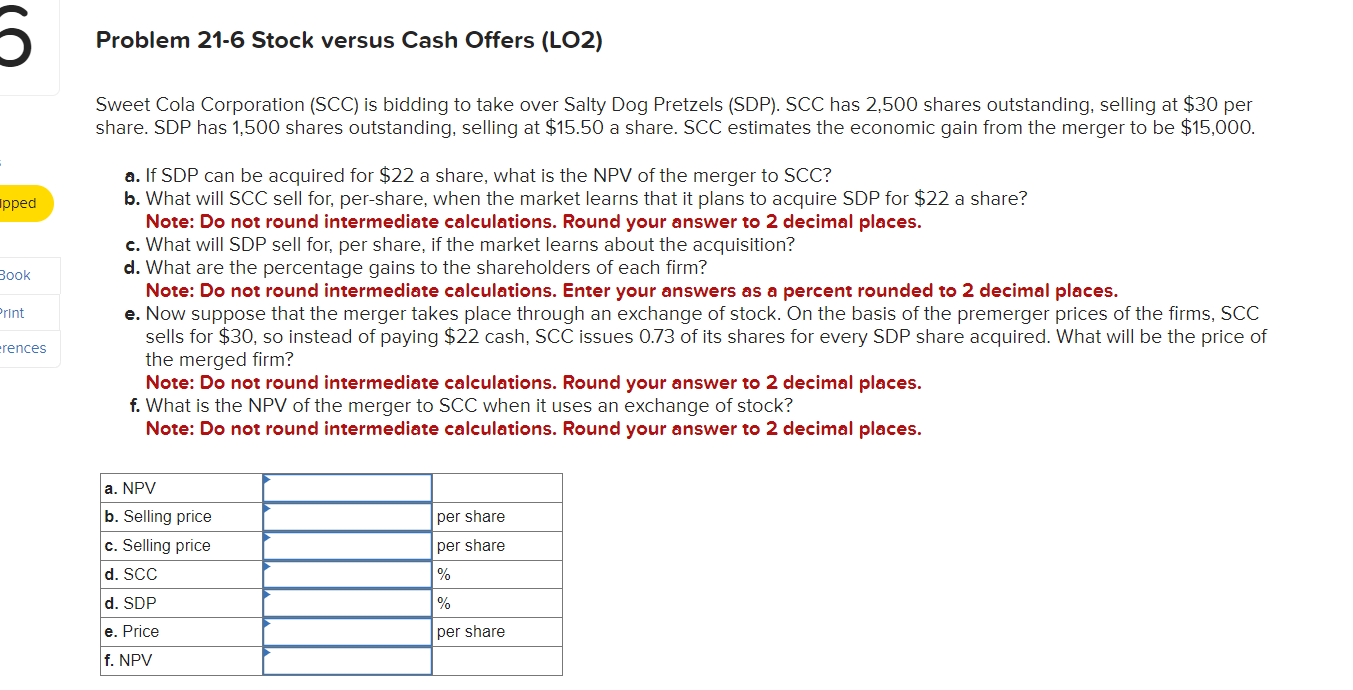

Question: Problem 2 1 - 6 Stock versus Cash Offers ( LO 2 ) Sweet Cola Corporation ( SCC ) is bidding to take over Salty

Problem Stock versus Cash Offers LO

Sweet Cola Corporation SCC is bidding to take over Salty Dog Pretzels SDP SCC has shares outstanding, selling at $ per

share. SDP has shares outstanding, selling at $ a share. SCC estimates the economic gain from the merger to be $

a If SDP can be acquired for $ a share, what is the NPV of the merger to SCC

b What will SCC sell for, pershare, when the market learns that it plans to acquire SDP for $ a share?

Note: Do not round intermediate calculations. Round your answer to decimal places.

c What will SDP sell for, per share, if the market learns about the acquisition?

d What are the percentage gains to the shareholders of each firm?

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to decimal places.

e Now suppose that the merger takes place through an exchange of stock. On the basis of the premerger prices of the firms, SCC

sells for $ so instead of paying $ cash, SCC issues of its shares for every SDP share acquired. What will be the price of

the merged firm?

Note: Do not round intermediate calculations. Round your answer to decimal places.

f What is the NPV of the merger to SCC when it uses an exchange of stock?

Note: Do not round intermediate calculations. Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock