Question: Problem #2 (10 Marks): Show all calculations 1. On April 30, 2019, our company borrowed $25,000 from a supplier of speciality gaming equipment. Our company

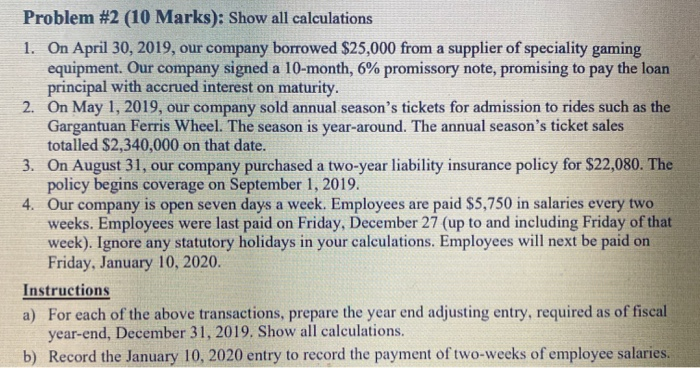

Problem #2 (10 Marks): Show all calculations 1. On April 30, 2019, our company borrowed $25,000 from a supplier of speciality gaming equipment. Our company signed a 10-month, 6% promissory note, promising to pay the loan principal with accrued interest on maturity. 2. On May 1, 2019, our company sold annual season's tickets for admission to rides such as the Gargantuan Ferris Wheel. The season is year-around. The annual season's ticket sales totalled $2,340,000 on that date. 3. On August 31, our company purchased a two-year liability insurance policy for $22,080. The policy begins coverage on September 1, 2019. 4. Our company is open seven days a week. Employees are paid $5,750 in salaries every two weeks. Employees were last paid on Friday, December 27 (up to and including Friday of that week). Ignore any statutory holidays in your calculations. Employees will next be paid on Friday, January 10, 2020. Instructions a) For each of the above transactions, prepare the year end adjusting entry, required as of fiscal year-end, December 31, 2019. Show all calculations. b) Record the January 10, 2020 entry to record the payment of two weeks of employee salaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts