Question: Problem 2 (10 points) Consider a stock whose price per share is modeled by using the standard geometric Brownian motion model dS(t) = rS(t)dt +

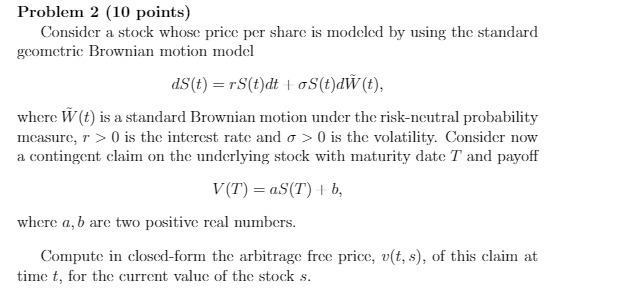

Problem 2 (10 points) Consider a stock whose price per share is modeled by using the standard geometric Brownian motion model dS(t) = rS(t)dt + oS(t)dW(t). where W(t) is a standard Brownian motion under the risk-neutral probability measure, " > 0 is the interest rate and o > 0 is the volatility. Consider now a contingent claim on the underlying stock with maturity date T and payoff V(T) = as(T) + b, where a, b are two positive real numbers. Compute in closed-form the arbitrage free price, v(t, s), of this claim at time t, for the current value of the stock s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts