Question: Problem 2 (100 points): Pedro and Maria Sanchez have recently sold their family business for $10 million and immigrated to the United States from Mexico.

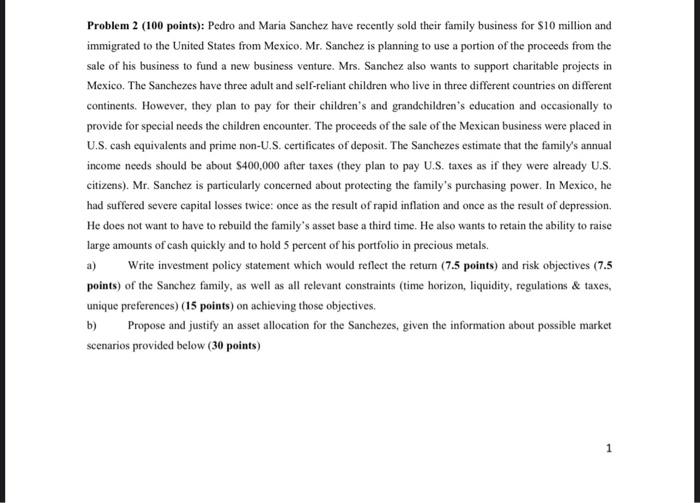

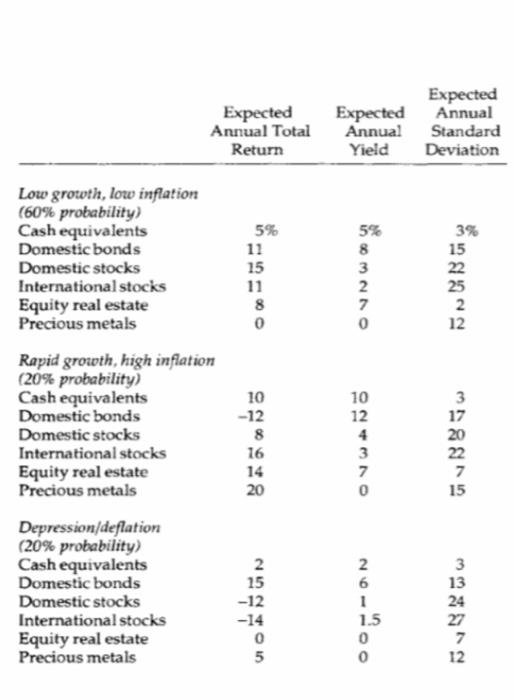

It is now three years later. The portfolio is worth $12 million. Mr. Sanchez has decided to join a privately held international investment group specializing in global mineral extraction. He is now contemplating investing $5 million for a royalty interest in an Australian oil field. He expects that his return on this investment will approximate \$1.5 million annually for 10 year. There is no information on the riskiness of the royalty payments. c) Can the existing investment policy accommodate such an investment? If not, how should the policy be modified? Propose changes regarding risk, rate of return and constraints. (20 points) d) What, if any, asset allocation revision would you recommend, if Mr. Sanchez makes the investment and if the expected royalty level materializes? (20 points) Problem 2 (100 points): Pedro and Maria Sanchez have recently sold their family business for S10 million and immigrated to the United States from Mexico. Mr. Sanchez is planning to use a portion of the proceeds from the sale of his business to fund a new business venture. Mrs. Sanchez also wants to support charitable projects in Mexico. The Sanchezes have three adult and self-reliant children who live in three different countries on different continents. However, they plan to pay for their children's and grandchildren's education and occasionally to provide for special needs the children encounter. The proceeds of the sale of the Mexican business were placed in U.S. cash equivalents and prime non-U.S. certificates of deposit. The Sanchezes estimate that the family's annual income needs should be about $400,000 after taxes (they plan to pay U.S. taxes as if they were already U.S. citizens). Mr. Sanchez is particularly concerned about protecting the family's purchasing power. In Mexico, he had suffered severe capital losses twice: once as the result of rapid inflation and once as the result of depression. He does not want to have to rebuild the family's asset base a third time. He also wants to retain the ability to raise large amounts of cash quickly and to hold 5 percent of his portfolio in precious metals. a) Write investment policy statement which would reflect the return (7.5 points) and risk objectives (7.5 points) of the Sanchez family, as well as all relevant constraints (time horizon, liquidity, regulations \& taxes, unique preferences) (15 points) on achieving those objectives. b) Propose and justify an asset allocation for the Sanchezes, given the information about possible market scenarios provided below (30 points) Low growth, low inflation (60\% probability) CashequivalentsDomesticbondsDomesticstocksInternationalstocksEquityrealestatePreciousmetals5%111511805%832703%152225212 Rapid growth, high inflation (20\% probability) Cash equivalents Domestic bonds Domestic stocks International stocks Equity real estate Precious metals 10128161420101243703172022715 Depression/deflation (20\% probability) Cash equivalents Domestic bonds Domestic stocks International stocks Equity real estate Precious metals 2151214052611.5003132427712

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts