Question: PROBLEM 2: (12 marks) ABC Inc. has common and preferred stock outstanding. The preferred stock pays an annual dividend of $8.00 per share, and the

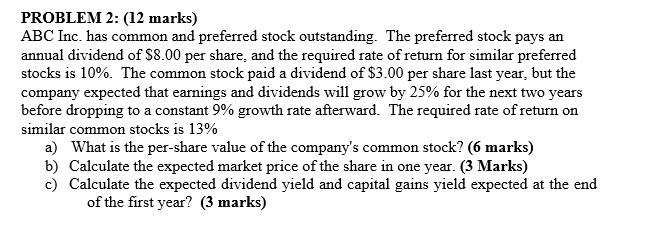

PROBLEM 2: (12 marks) ABC Inc. has common and preferred stock outstanding. The preferred stock pays an annual dividend of $8.00 per share, and the required rate of return for similar preferred stocks is 10%. The common stock paid a dividend of $3.00 per share last year, but the company expected that earnings and dividends will grow by 25% for the next two years before dropping to a constant 9% growth rate afterward. The required rate of return on similar common stocks is 13% a) What is the per-share value of the company's common stock? (6 marks) b) Calculate the expected market price of the share in one year. (3 Marks) c) Calculate the expected dividend yield and capital gains yield expected at the end of the first year? ( 3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts