Question: Problem 2: (12 marks) Conaco Manufacturing needs to raise $20 million for the current capital budget. Currently, the firm is an all-equity firm that has

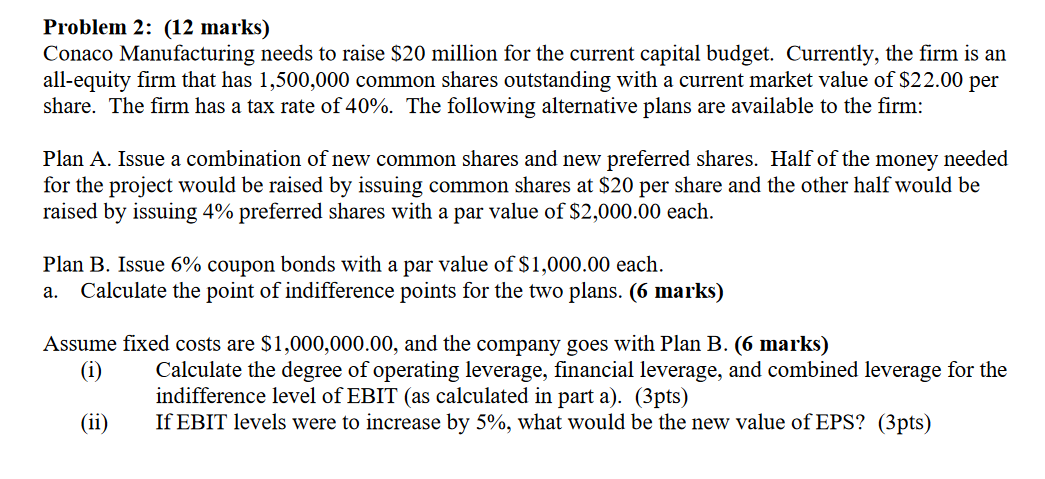

Problem 2: (12 marks) Conaco Manufacturing needs to raise $20 million for the current capital budget. Currently, the firm is an all-equity firm that has 1,500,000 common shares outstanding with a current market value of $22.00 per share. The firm has a tax rate of 40%. The following alternative plans are available to the firm: Plan A. Issue a combination of new common shares and new preferred shares. Half of the money needed for the project would be raised by issuing common shares at $20 per share and the other half would be raised by issuing 4% preferred shares with a par value of $2,000.00 each. Plan B. Issue 6% coupon bonds with a par value of $1,000.00 each. Calculate the point of indifference points for the two plans. (6 marks) a. Assume fixed costs are $1,000,000.00, and the company goes with Plan B. (6 marks) (i) Calculate the degree of operating leverage, financial leverage, and combined leverage for the indifference level of EBIT (as calculated in part a). (3pts) (ii) If EBIT levels were to increase by 5%, what would be the new value of EPS? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts