Question: Problem 2 (12 points):Similar to question 1, assume that forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=8% and r(2)=9%. In

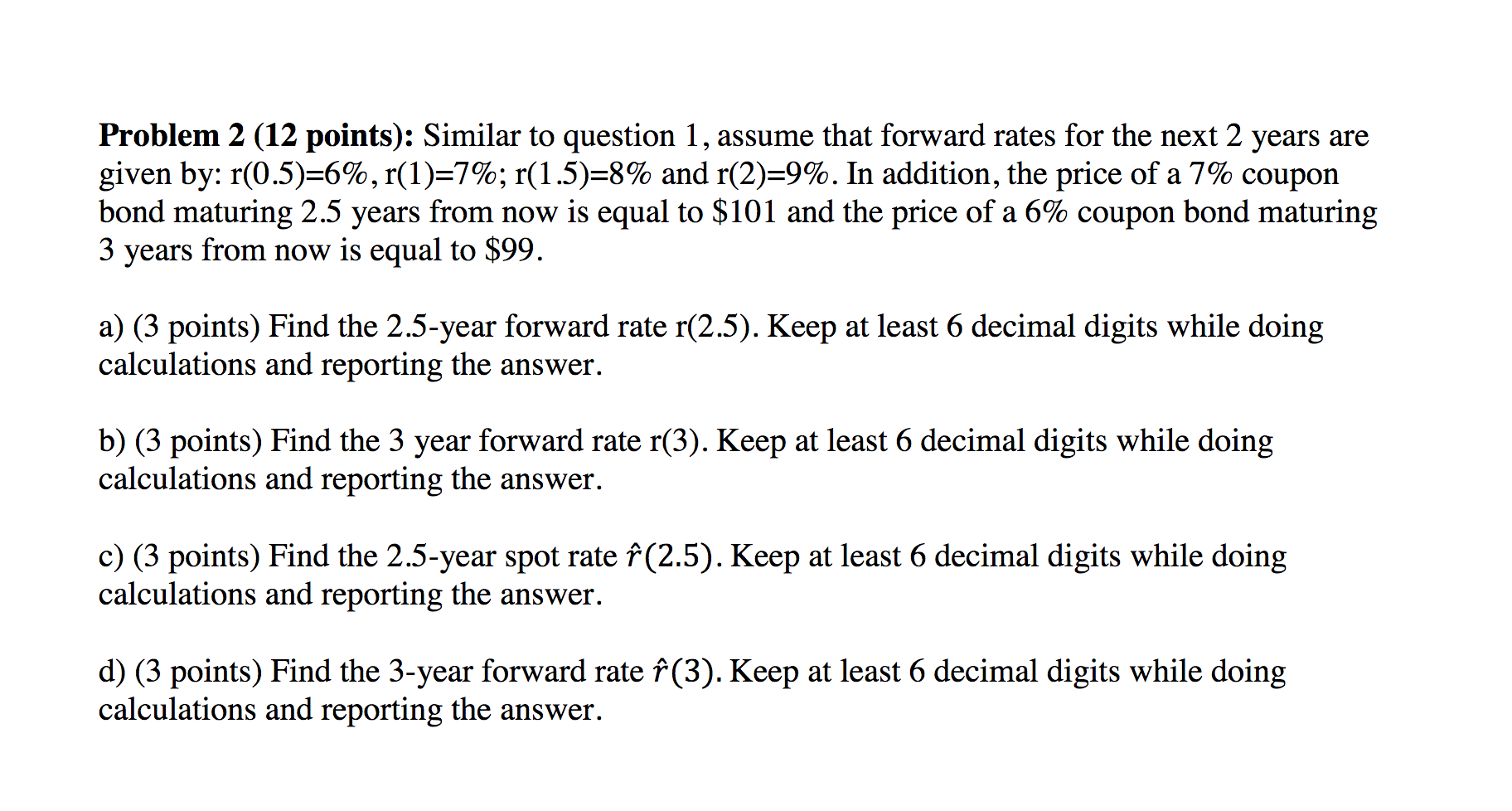

Problem 2 (12 points):Similar to question 1, assume that forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=8% and r(2)=9%. In addition, the price of a 7% coupon bond maturing 2.5 years from now is equal to $101and the price of a 6% coupon bond maturing 3 years from now is equal to $99.

Problem 2 (12 points):Similar to question 1, assume that forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=8% and r(2)=9%. In addition, the price of a 7% coupon bond maturing 2.5 years from now is equal to $101and the price of a 6% coupon bond maturing 3 years from now is equal to $99.

a) (3points) Find the 2.5-year forward rate r(2.5). Keep at least 6 decimal digits while doing calculations and reporting the answer.

b) (3 points) Find the 3-year forward rate r(3). Keep at least 6 decimal digits while doing calculations and reporting the answer.

c) (3 points) Find the 2.5-year spot rate (2.5). Keep at least 6 decimal digits while doing calculations and reporting the answer.

d) (3 points) Find the 3-year forward rate (3). Keep at least 6 decimal digits while doing calculations and reporting the answer.

Problem 2 (12 points): Similar to question 1, assume that forward rates for the next 2 years are given by: r(0.5)=6%, r(1)=7%; r(1.5)=8% and r(2)=9%. In addition, the price of a 7% coupon bond maturing 2.5 years from now is equal to $101 and the price of a 6% coupon bond maturing 3 years from now is equal to $99. a) (3 points) Find the 2.5-year forward rate r(2.5). Keep at least 6 decimal digits while doing calculations and reporting the answer. b) (3 points) Find the 3 year forward rate r(3). Keep at least 6 decimal digits while doing calculations and reporting the answer. c) (3 points) Find the 2.5-year spot rate f (2.5). Keep at least 6 decimal digits while doing calculations and reporting the answer. d) (3 points) Find the 3-year forward rate f(3). Keep at least 6 decimal digits while doing calculations and reporting the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts