Question: Problem #2 (13 points) Prepare a multi-step income statement (using good form) for the Christensen Corporation. Christensen Corporation had the following items on Dec. 31,

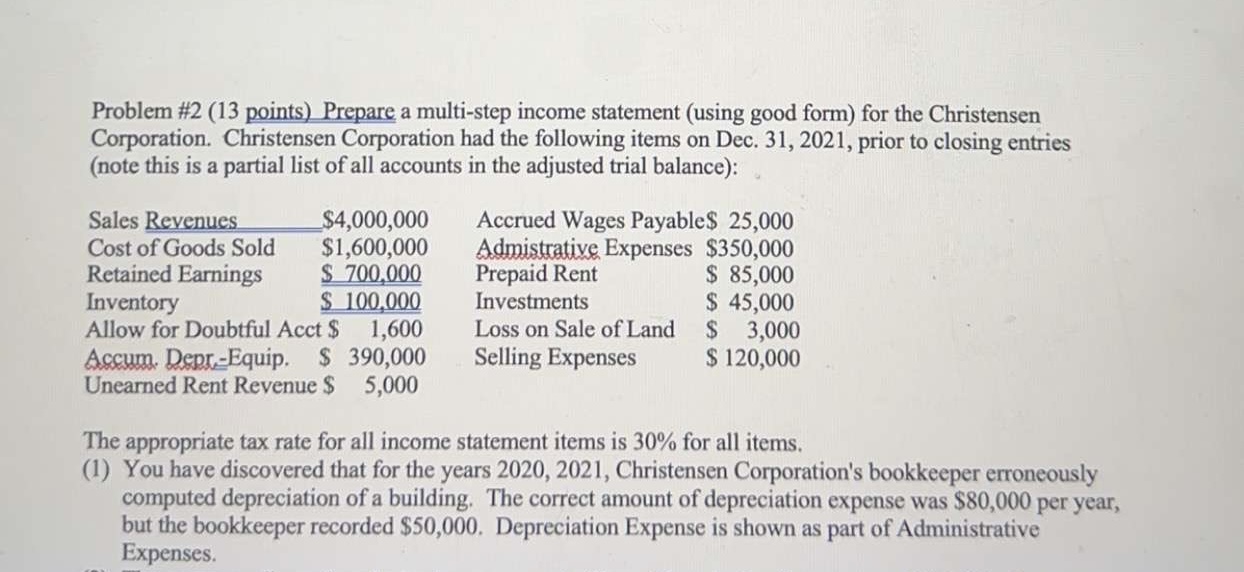

Problem \#2 (13 points) Prepare a multi-step income statement (using good form) for the Christensen Corporation. Christensen Corporation had the following items on Dec. 31, 2021, prior to closing entries (note this is a partial list of all accounts in the adjusted trial balance): The appropriate tax rate for all income statement items is 30% for all items. (1) You have discovered that for the years 2020, 2021, Christensen Corporation's bookkeeper erroneously computed depreciation of a building. The correct amount of depreciation expense was $80,000 per year, but the bookkeeper recorded \$50,000. Depreciation Expense is shown as part of Administrative Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts