Question: Problem 2: (16 marks) Four and a half years ago, you purchased at par, a 10 year 6% coupon bond that pays semi-annual interest. Today

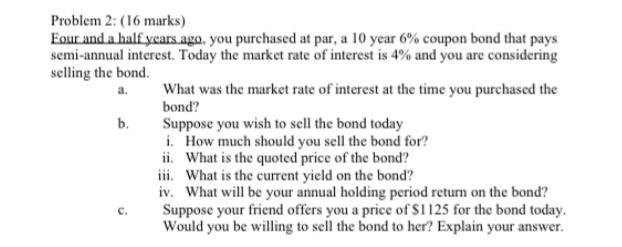

Problem 2: (16 marks) Four and a half years ago, you purchased at par, a 10 year 6% coupon bond that pays semi-annual interest. Today the market rate of interest is 4% and you are considering selling the bond. a. What was the market rate of interest at the time you purchased the bond? b. Suppose you wish to sell the bond today i. How much should you sell the bond for? What is the quoted price of the bond? iii. What is the current yield on the bond? ii. iv. What will be your annual holding period return on the bond? Suppose your friend offers you a price of $1125 for the bond today. Would you be willing to sell the bond to her? Explain your answer. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts