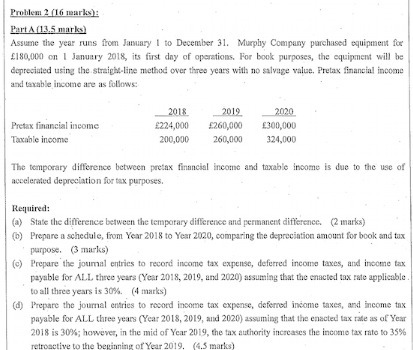

Question: Problem 2 (16 marks): PartA(13.5 marks Assume the year runs from January 1 to December 31. Murphy Company purchased equipment for $180 000 on 1

Problem 2 (16 marks): PartA(13.5 marks Assume the year runs from January 1 to December 31. Murphy Company purchased equipment for $180 000 on 1 January 2018, its first day of operations. For book purposes, the equipment will be depreciated using the straight-line method over three years with no salvage value, Pretax financial income and taxable income are as follows: 20183 2019 2020 Pretax financial income $224,000 $260,090 Taxable income 200,000 260,000 324,000 The temporary difference between pretax financial income and taxable income is due to the use of accelerated depreciation for tax purposes. Required: (a) State the difference between the temporary difference and permanent difference. (2 marks) (b) Prepare a schedule, from Year 2018 to Year 2020, comparing the depreciation amount for book and fox purpose. (3 marks) (c) Prepare the journal entries to record income tax expense, deferred income taxes, and income tax payable for ALL three years (Year 2018, 2019, and 2020) assuming that the enacted tax rate applicable to all three years is 30%%. (4 marks) (d) Prepare the journal entries to record income tax expense, deferred income taxes, and income tax payable for ALL three years (Year 2018, 2019, and 2020) assuming that the enacted tax rate as of Year 2018 is 30%%; however, in the mid of Year 2019, the tax authority increases the income tax rate to 35% retroactive to the beginning of Year 2019. (4.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts