Question: Problem 2 ( 2 0 points ) : Evaluate the following pure - yield pickup swap: You currently hold a 2 0 yearm AA -

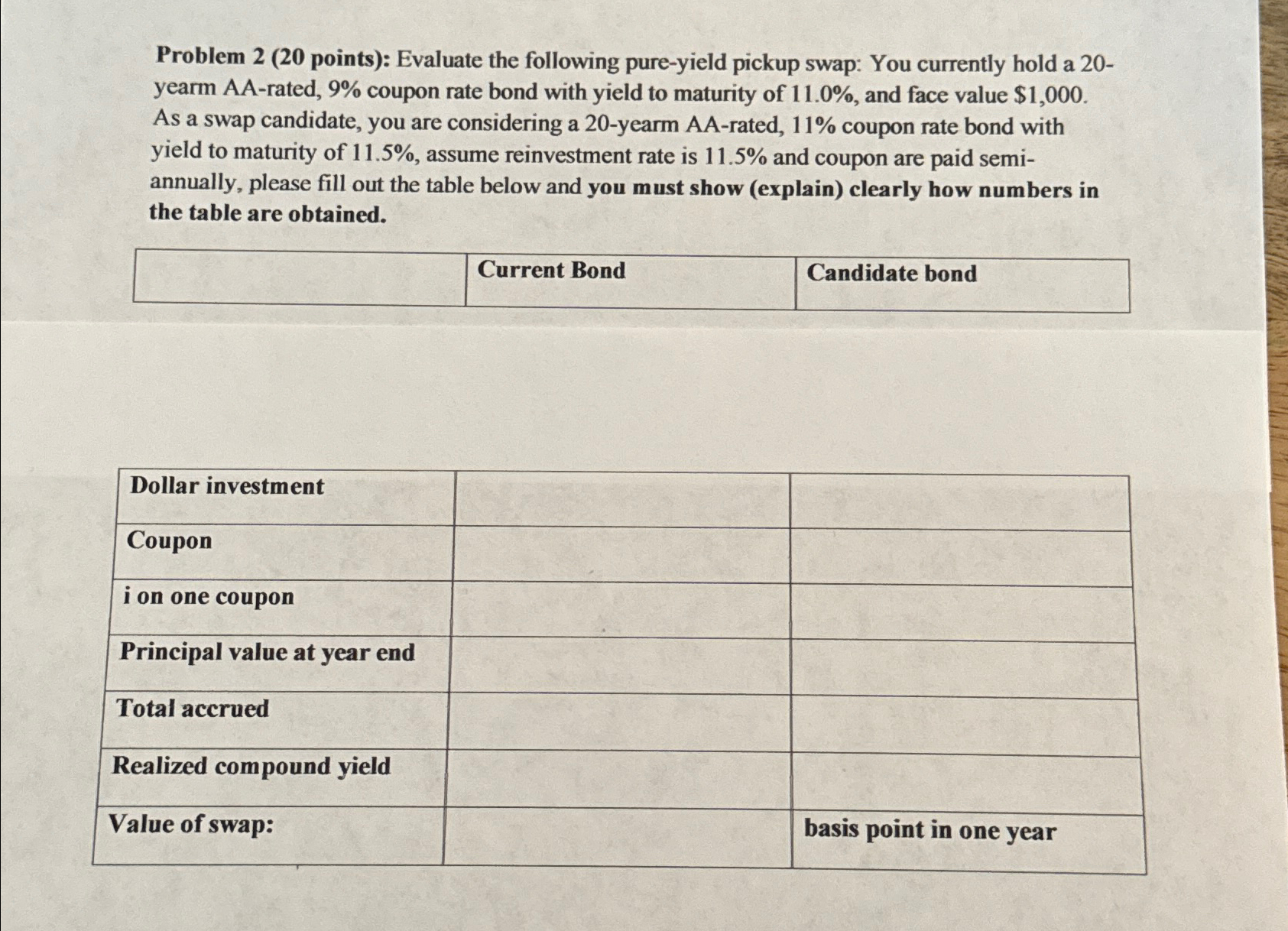

Problem points: Evaluate the following pureyield pickup swap: You currently hold a yearm AArated, coupon rate bond with yield to maturity of and face value $ As a swap candidate, you are considering a yearm AArated, coupon rate bond with yield to maturity of assume reinvestment rate is and coupon are paid semiannually, please fill out the table below and you must show explain clearly how numbers in the table are obtained.

Current Bond

Candidate bond

tableDollar investment,,Couponi on one coupon,,Principal value at year end,,Total accrued,,Realized compound yield,,Value of swap:,,basis point in one year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock