Question: Problem 2 : ( 2 0 points ) Let us consider an extension of the lending decision problem from class. The lender is now deciding

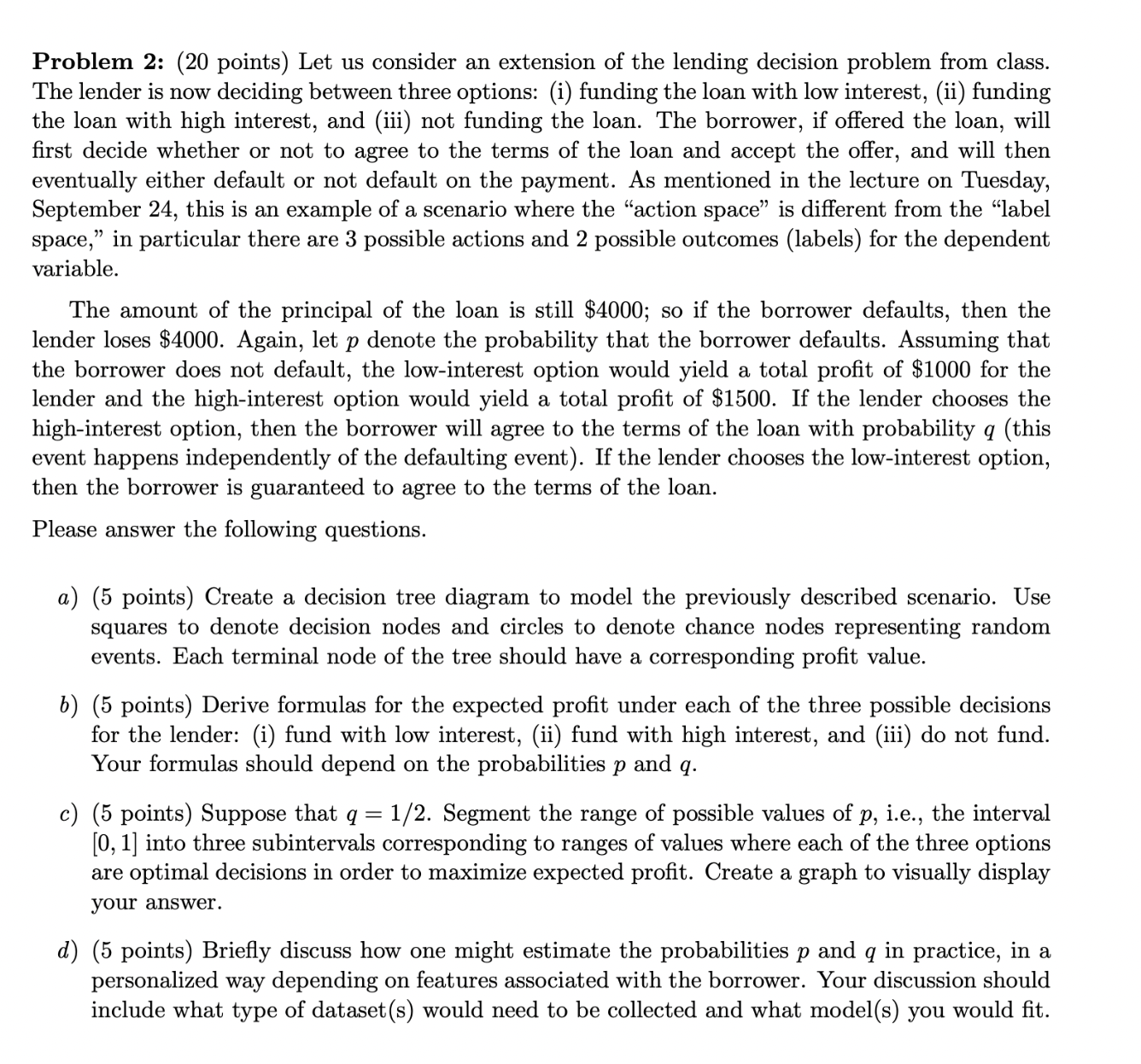

Problem : points Let us consider an extension of the lending decision problem from class.

The lender is now deciding between three options: i funding the loan with low interest, ii funding

the loan with high interest, and iii not funding the loan. The borrower, if offered the loan, will

first decide whether or not to agree to the terms of the loan and accept the offer, and will then

eventually either default or not default on the payment. As mentioned in the lecture on Tuesday,

September this is an example of a scenario where the "action space" is different from the "label

space," in particular there are possible actions and possible outcomes labels for the dependent

variable.

The amount of the principal of the loan is still $; so if the borrower defaults, then the

lender loses $ Again, let denote the probability that the borrower defaults. Assuming that

the borrower does not default, the lowinterest option would yield a total profit of $ for the

lender and the highinterest option would yield a total profit of $ If the lender chooses the

highinterest option, then the borrower will agree to the terms of the loan with probability this

event happens independently of the defaulting event If the lender chooses the lowinterest option,

then the borrower is guaranteed to agree to the terms of the loan.

Please answer the following questions.

a points Create a decision tree diagram to model the previously described scenario. Use

squares to denote decision nodes and circles to denote chance nodes representing random

events. Each terminal node of the tree should have a corresponding profit value.

b points Derive formulas for the expected profit under each of the three possible decisions

for the lender: i fund with low interest, ii fund with high interest, and iii do not fund.

Your formulas should depend on the probabilities and

c points Suppose that Segment the range of possible values of ie the interval

into three subintervals corresponding to ranges of values where each of the three options

are optimal decisions in order to maximize expected profit. Create a graph to visually display

your answer.

d points Briefly discuss how one might estimate the probabilities and in practice, in a

personalized way depending on features associated with the borrower. Your discussion should

include what type of datasets would need to be collected and what models you would fit.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock