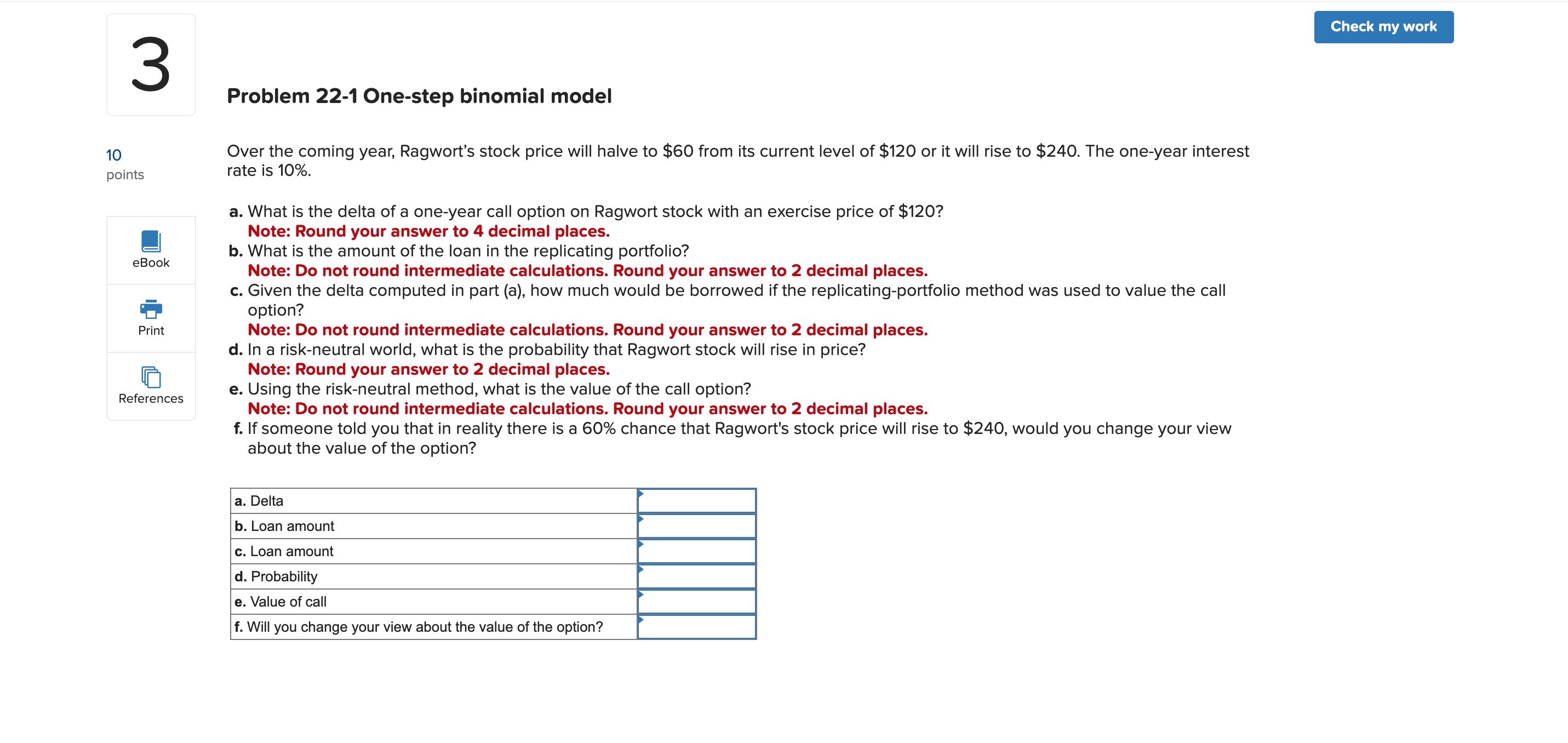

Question: Problem 2 2 - 1 One - step binomial model Over the coming year, Ragwort's stock price will halve to $ 6 0 from its

Problem Onestep binomial model

Over the coming year, Ragwort's stock price will halve to $ from its current level of $ or it will rise to $ The oneyear interest

rate is

a What is the delta of a oneyear call option on Ragwort stock with an exercise price of $

Note: Round your answer to decimal places.

b What is the amount of the loan in the replicating portfolio?

Note: Do not round intermediate calculations. Round your answer to decimal places.

c Given the delta computed in part a how much would be borrowed if the replicatingportfolio method was used to value the call

option?

Note: Do not round intermediate calculations. Round your answer to decimal places.

d In a riskneutral world, what is the probability that Ragwort stock will rise in price?

Note: Round your answer to decimal places.

e Using the riskneutral method, what is the value of the call option?

Note: Do not round intermediate calculations. Round your answer to decimal places.

f If someone told you that in reality there is a chance that Ragwort's stock price will rise to $ would you change your view

about the value of the option?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock