Question: Problem 2 - 2 3 Dividend Income ( LO 2 . 1 0 ) a . Respond to the following: In 2 0 2 4

Problem

Dividend Income LO

a Respond to the following: In how are qualified dividends taxed?

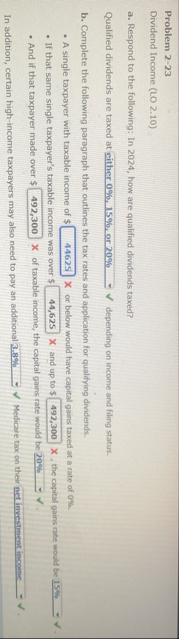

Qualified dividends are taxed at cither or depending on income and filing status.

b Complete the following paragraph that outlines the tax rates and application for qualifying dividends.

A single taxpayer with taxable income of $ or below would have capital gains taxed at a rate of

If that same single taxpayer's taxable income was over $ and up to $ the capital gains rate would be

And if that taxpayer made over $ of taxable income, the capital gains rate would be

In addition, certain highincome taxpayers may also need to pay an additional Medicare tax on their net inved ment income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock