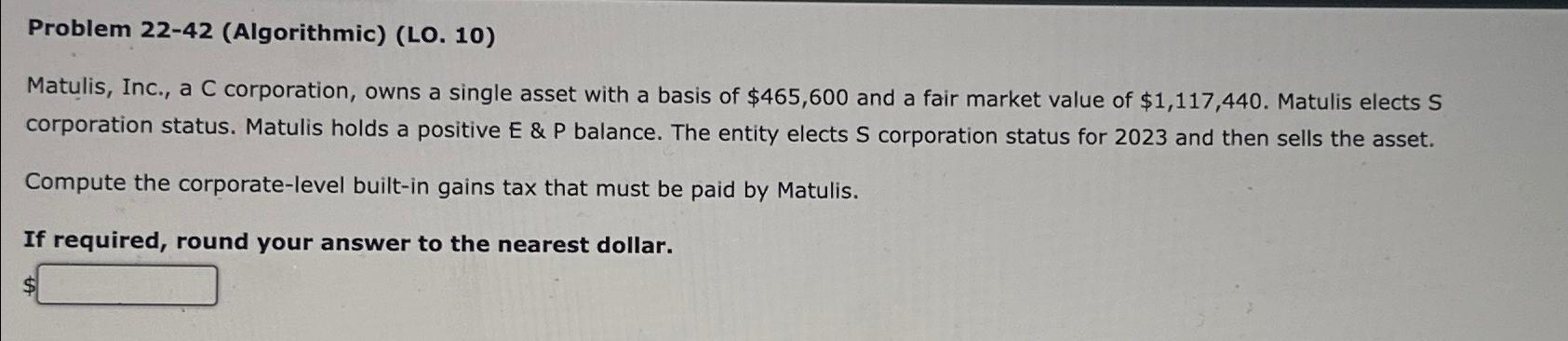

Question: Problem 2 2 - 4 2 ( Algorithmic ) ( LO . 1 0 ) Matulis, Inc., a C corporation, owns a single asset with

Problem AlgorithmicLO

Matulis, Inc., a C corporation, owns a single asset with a basis of $ and a fair market value of $ Matulis elects corporation status. Matulis holds a positive E & P balance. The entity elects corporation status for and then sells the asset.

Compute the corporatelevel builtin gains tax that must be paid by Matulis.

If required, round your answer to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock