Question: Problem 2 ( 2 5 points ) Landmark leased an equipment from Efficient Machine on January 1 , 2 0 2 4 . The 4

Problem points

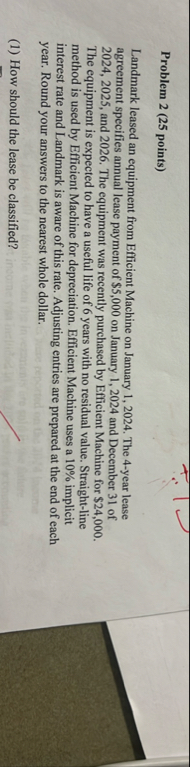

Landmark leased an equipment from Efficient Machine on January The year lease agreement specifies annual lease payment of $ on January and December of and The equipment was recently purchased by Efficient Machine for $ The equipment is expected to have a useful life of years with no residual value. Straightline method is used by Efficient Machine for depreciation. Efficient Machine uses a implicit interest rate and Landmark is aware of this rate. Adjusting entries are prepared at the end of each year. Round your answers to the nearest whole dollar.

How should the lease be classified?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock