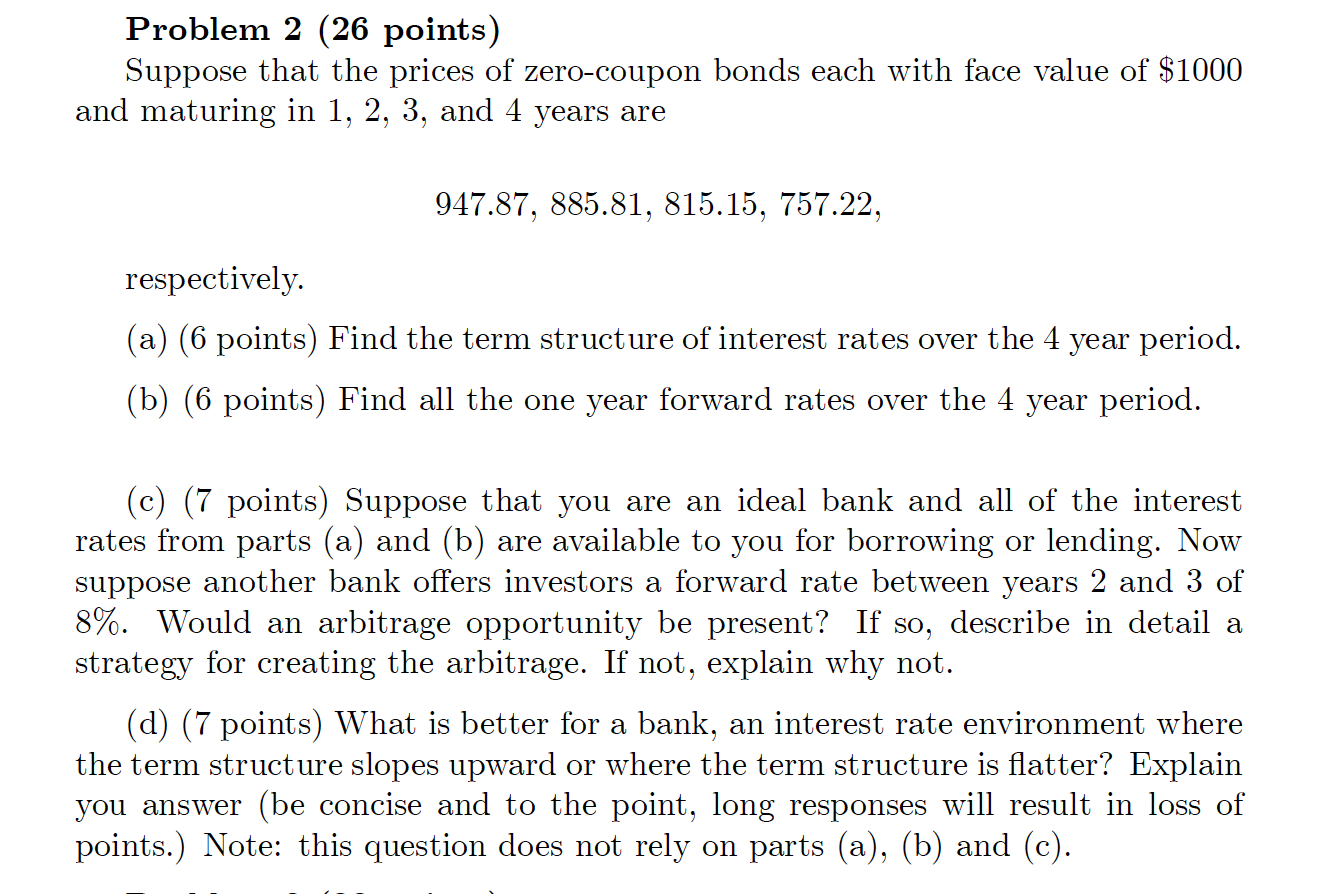

Question: Problem 2 ( 2 6 points ) Suppose that the prices of zero - coupon bonds each with face value of $ 1 0 0

Problem points

Suppose that the prices of zerocoupon bonds each with face value of $

and maturing in and years are

respectively.

a points Find the term structure of interest rates over the year period.

b points Find all the one year forward rates over the year period.

c points Suppose that you are an ideal bank and all of the interest

rates from parts a and b are available to you for borrowing or lending. Now

suppose another bank offers investors a forward rate between years and of

Would an arbitrage opportunity be present? If so describe in detail a

strategy for creating the arbitrage. If not, explain why not.

d points What is better for a bank, an interest rate environment where

the term structure slopes upward or where the term structure is flatter? Explain

you answer be concise and to the point, long responses will result in loss of

points. Note: this question does not rely on parts ab and c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock