Question: Problem 2 (20 points) A company entered into a swap agreement where it pays six-month LIBOR and receives 7.5% (semi-annual payment) on a principal of

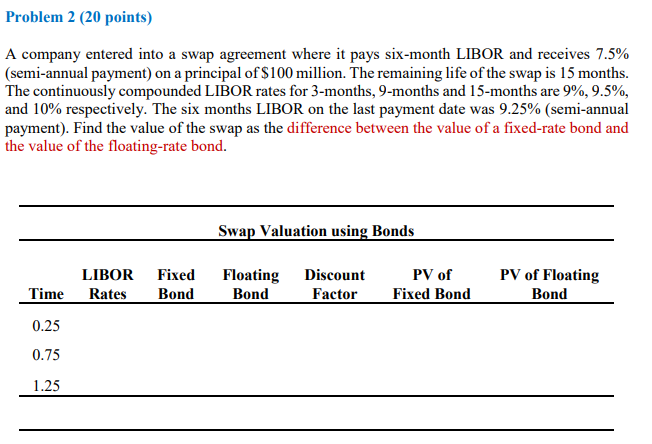

Problem 2 (20 points) A company entered into a swap agreement where it pays six-month LIBOR and receives 7.5% (semi-annual payment) on a principal of $100 million. The remaining life of the swap is 15 months. The continuously compounded LIBOR rates for 3-months, 9-months and 15-months are 9%, 9.5%, and 10% respectively. The six months LIBOR on the last payment date was 9.25% (semi-annual payment). Find the value of the swap as the difference between the value of a fixed-rate bond and the value of the floating-rate bond. Swap Valuation using Bonds LIBOR Rates Fixed Bond Floating Discount Bond Factor Time PV of Fixed Bond PV of Floating Bond 0.25 0.75 1.25 Problem 2 (20 points) A company entered into a swap agreement where it pays six-month LIBOR and receives 7.5% (semi-annual payment) on a principal of $100 million. The remaining life of the swap is 15 months. The continuously compounded LIBOR rates for 3-months, 9-months and 15-months are 9%, 9.5%, and 10% respectively. The six months LIBOR on the last payment date was 9.25% (semi-annual payment). Find the value of the swap as the difference between the value of a fixed-rate bond and the value of the floating-rate bond. Swap Valuation using Bonds LIBOR Rates Fixed Bond Floating Discount Bond Factor Time PV of Fixed Bond PV of Floating Bond 0.25 0.75 1.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts