Question: Problem 2 - 20 points Capital Structure Mix (Show me real insight in your answer) Moody Blues Inc. is considering an expansion of Manufacturing Capacity.

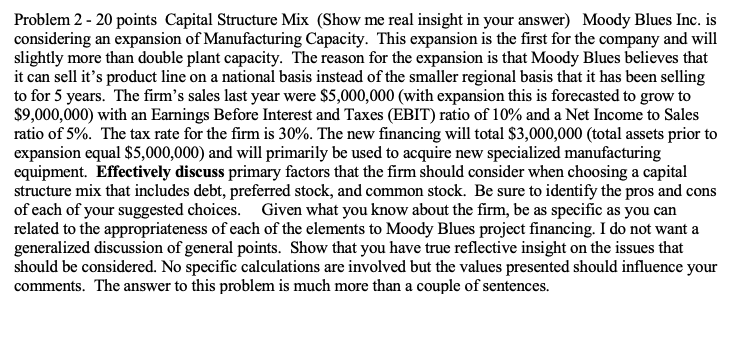

Problem 2 - 20 points Capital Structure Mix (Show me real insight in your answer) Moody Blues Inc. is considering an expansion of Manufacturing Capacity. This expansion is the first for the company and will slightly more than double plant capacity. The reason for the expansion is that Moody Blues believes that it can sell it's product line on a national basis instead of the smaller regional basis that it has been selling to for 5 years. The firm's sales last year were $5,000,000 (with expansion this is forecasted to grow to $9,000,000) with an Earnings Before Interest and Taxes (EBIT) ratio of 10% and a Net Income to Sales ratio of 5%. The tax rate for the firm is 30%. The new financing will total $3,000,000 (total assets prior to expansion equal $5,000,000) and will primarily be used to acquire new specialized manufacturing equipment. Effectively discuss primary factors that the firm should consider when choosing a capital structure mix that includes debt, preferred stock, and common stock. Be sure to identify the pros and cons of each of your suggested choices. Given what you know about the firm, be as specific as you can related to the appropriateness of each of the elements to Moody Blues project financing. I do not want a generalized discussion of general points. Show that you have true reflective insight on the issues that should be considered. No specific calculations are involved but the values presented should influence your comments. The answer to this problem is much more than a couple of sentences. Problem 2 - 20 points Capital Structure Mix (Show me real insight in your answer) Moody Blues Inc. is considering an expansion of Manufacturing Capacity. This expansion is the first for the company and will slightly more than double plant capacity. The reason for the expansion is that Moody Blues believes that it can sell it's product line on a national basis instead of the smaller regional basis that it has been selling to for 5 years. The firm's sales last year were $5,000,000 (with expansion this is forecasted to grow to $9,000,000) with an Earnings Before Interest and Taxes (EBIT) ratio of 10% and a Net Income to Sales ratio of 5%. The tax rate for the firm is 30%. The new financing will total $3,000,000 (total assets prior to expansion equal $5,000,000) and will primarily be used to acquire new specialized manufacturing equipment. Effectively discuss primary factors that the firm should consider when choosing a capital structure mix that includes debt, preferred stock, and common stock. Be sure to identify the pros and cons of each of your suggested choices. Given what you know about the firm, be as specific as you can related to the appropriateness of each of the elements to Moody Blues project financing. I do not want a generalized discussion of general points. Show that you have true reflective insight on the issues that should be considered. No specific calculations are involved but the values presented should influence your comments. The answer to this problem is much more than a couple of sentences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts