Question: Problem #2 (20 points) Green Vegetable Mfg. Co. purchased equipment on January 1, 2018, at a cost of $800,000. The equipment is expected to have

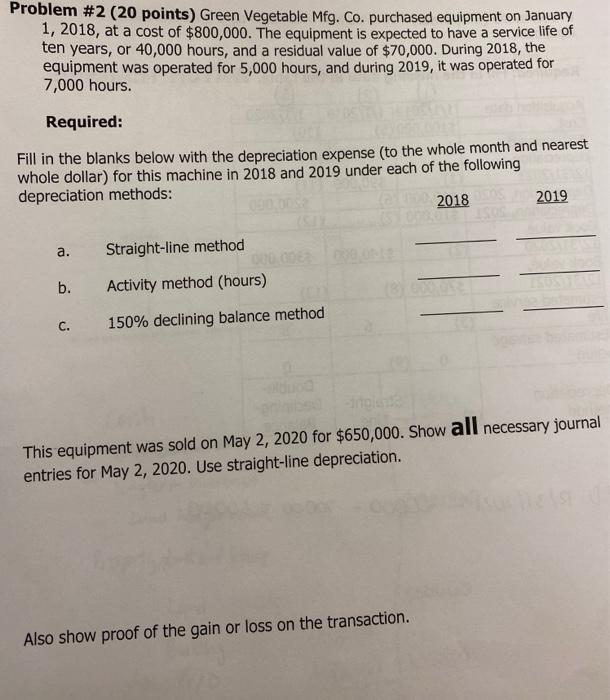

Problem #2 (20 points) Green Vegetable Mfg. Co. purchased equipment on January 1, 2018, at a cost of $800,000. The equipment is expected to have a service life of ten years, or 40,000 hours, and a residual value of $70,000. During 2018, the equipment was operated for 5,000 hours, and during 2019, it was operated for 7,000 hours. Required: Fill in the blanks below with the depreciation expense (to the whole month and nearest whole dollar) for this machine in 2018 and 2019 under each of the following depreciation methods: 2018 2019 a. Straight-line method b. Activity method (hours) C. 150% declining balance method This equipment was sold on May 2, 2020 for $650,000. Show all necessary journal entries for May 2, 2020. Use straight-line depreciation. Also show proof of the gain or loss on the transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts