Question: PROBLEM 2 (20 POINTS) Suppose there are two firms ABC and XYZ. Suppose company ABC wants to take on a project that is unrelated to

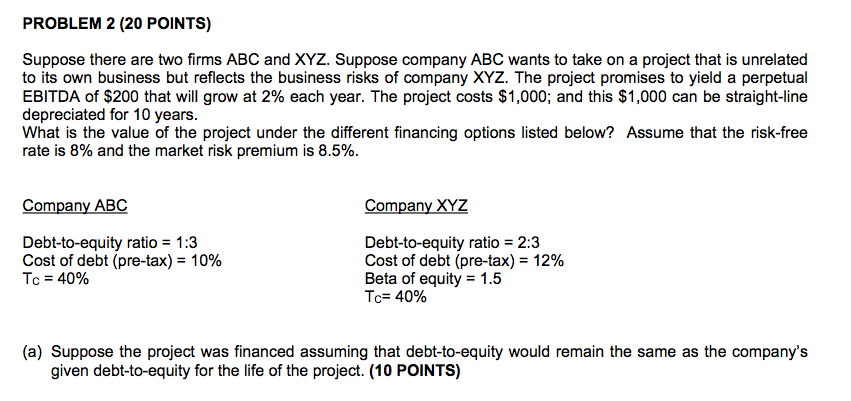

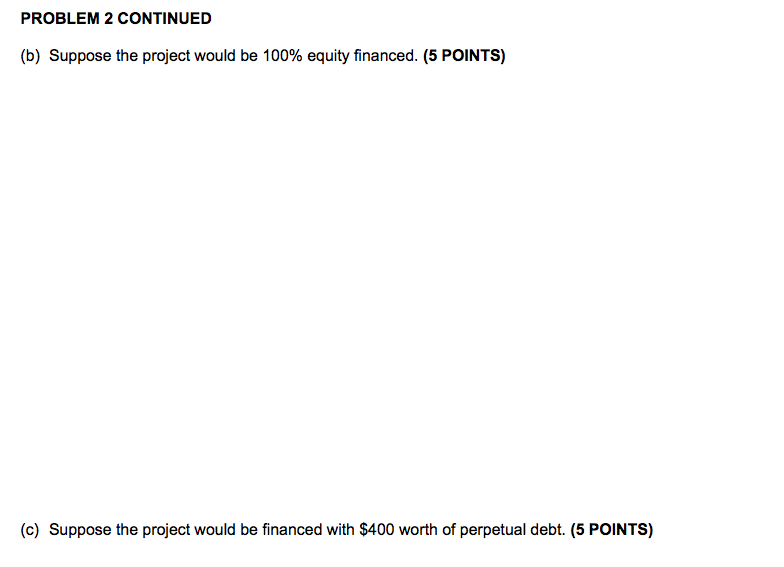

PROBLEM 2 (20 POINTS) Suppose there are two firms ABC and XYZ. Suppose company ABC wants to take on a project that is unrelated to its own business but reflects the business risks of company XYZ. The project promises to yield a perpetual EBITDA of $200 that will grow at 2% each year. The project costs $1,000, and this $1,000 can be straight-line depreciated for 10 years. What is the value of the project under the different financing options listed below? Assume that the risk-free rate is 8% and the market risk premium is 8.5%. Company ABC Company XYZ Debt-to-equity ratio 1:3 Cost of debt (pre-tax)-10% ?? 40% Debt-to-equity ratio 2:3 Cost of debt (pre-tax)-12% Beta of equity 1.5 Tc-40% (a) Suppose the project was financed assuming that debt-to-equity would remain the same as the company's given debt-to-equity for the life of the project. (10 POINTS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts