Question: Problem 2 (20 points) You are given the following quote for Eurodollar futures prices on Wednesday, 03/17/21: Month Open High Low Last APR 21 109.9825

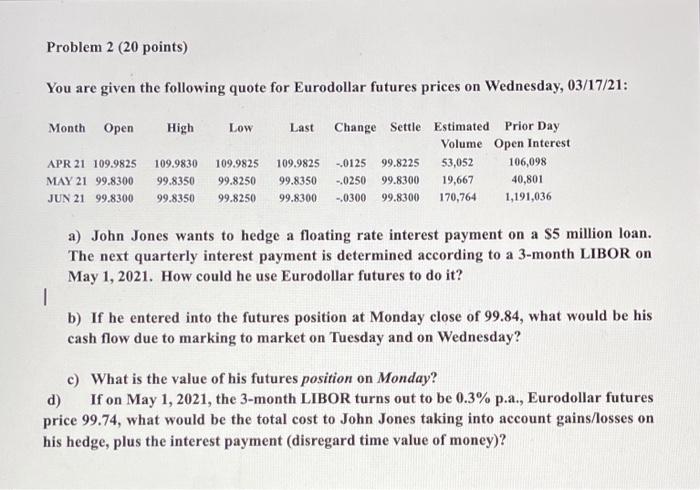

Problem 2 (20 points) You are given the following quote for Eurodollar futures prices on Wednesday, 03/17/21: Month Open High Low Last APR 21 109.9825 MAY 21 99.8300 JUN 21 99.8300 109.9830 99.8350 99.8350 109.9825 99.8250 99.8250 109.9825 99.8350 99.8300 Change Settle Estimated Prior Day Volume Open Interest --0125 99.8225 53,052 106,098 --0250 99.8300 19,667 40,801 -0300 99.8300 170,764 1,191,036 a) John Jones wants to hedge a floating rate interest payment on a $5 million loan. The next quarterly interest payment is determined according to a 3-month LIBOR on May 1, 2021. How could he use Eurodollar futures to do it? 1 b) If he entered into the futures position at Monday close of 99.84, what would be his cash flow due to marking to market on Tuesday and on Wednesday? c) What is the value of his futures position on Monday? d) If on May 1, 2021, the 3-month LIBOR turns out to be 0.3% p.a., Eurodollar futures price 99.74, what would be the total cost to John Jones taking into account gains/losses on his hedge, plus the interest payment (disregard time value of money)? Problem 2 (20 points) You are given the following quote for Eurodollar futures prices on Wednesday, 03/17/21: Month Open High Low Last APR 21 109.9825 MAY 21 99.8300 JUN 21 99.8300 109.9830 99.8350 99.8350 109.9825 99.8250 99.8250 109.9825 99.8350 99.8300 Change Settle Estimated Prior Day Volume Open Interest --0125 99.8225 53,052 106,098 --0250 99.8300 19,667 40,801 -0300 99.8300 170,764 1,191,036 a) John Jones wants to hedge a floating rate interest payment on a $5 million loan. The next quarterly interest payment is determined according to a 3-month LIBOR on May 1, 2021. How could he use Eurodollar futures to do it? 1 b) If he entered into the futures position at Monday close of 99.84, what would be his cash flow due to marking to market on Tuesday and on Wednesday? c) What is the value of his futures position on Monday? d) If on May 1, 2021, the 3-month LIBOR turns out to be 0.3% p.a., Eurodollar futures price 99.74, what would be the total cost to John Jones taking into account gains/losses on his hedge, plus the interest payment (disregard time value of money)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts