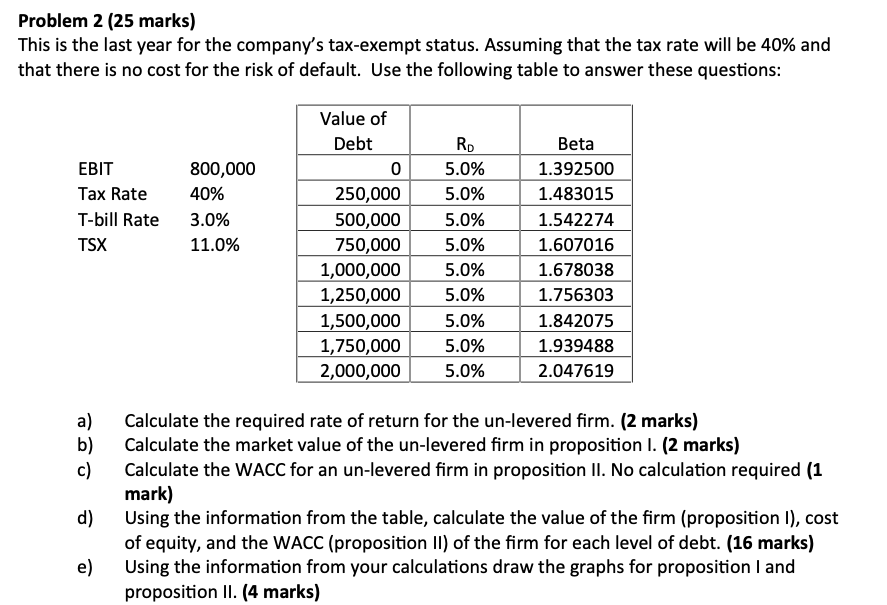

Question: Problem 2 (25 marks) This is the last year for the company's tax-exempt status. Assuming that the tax rate will be 40% and that there

Problem 2 (25 marks) This is the last year for the company's tax-exempt status. Assuming that the tax rate will be 40% and that there is no cost for the risk of default. Use the following table to answer these questions: EBIT Tax Rate T-bill Rate TSX 800,000 40% 3.0% 11.0% Value of Debt 0 250,000 500,000 750,000 1,000,000 1,250,000 1,500,000 1,750,000 2,000,000 RD 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% Beta 1.392500 1.483015 1.542274 1.607016 1.678038 1.756303 1.842075 1.939488 2.047619 a) b) c) Calculate the required rate of return for the un-levered firm. (2 marks) Calculate the market value of the un-levered firm in proposition I. (2 marks) Calculate the WACC for an un-levered firm in proposition II. No calculation required (1 mark) Using the information from the table, calculate the value of the firm (proposition 1), cost of equity, and the WACC (proposition II) of the firm for each level of debt. (16 marks) Using the information from your calculations draw the graphs for proposition I and proposition II. (4 marks) d) e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts