Question: Problem 2 (25 points) Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase

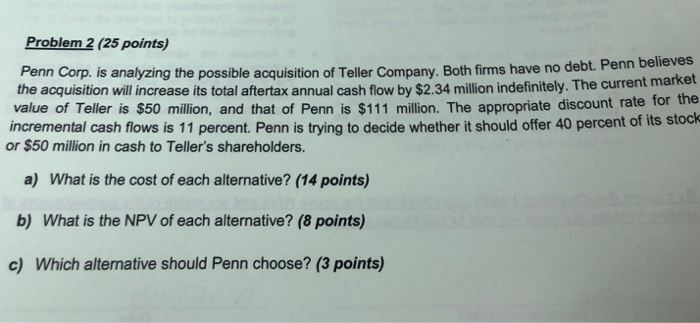

Problem 2 (25 points) Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flow by $2.34 million indefinitely. The current market value of Teller is $50 million, and that of Penn is $111 million. The appropriate discount rate for the incremental cash flows is 11 percent. Penn is trying to decide whether it should offer 40 percent of its stock or $50 million in cash to Teller's shareholders. a) What is the cost of each alternative? (14 points) b) What is the NPV of each alternative? (8 points) c) Which alternative should Penn choose? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts