Question: Problem 2 (25 points). The comparative balance sheets for Colorado Company are attached for the years ending December 31. 20X2 and 20X3. The following additional

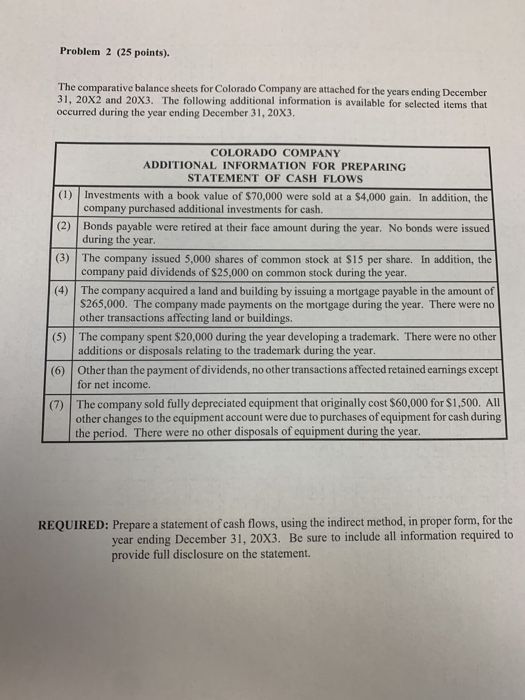

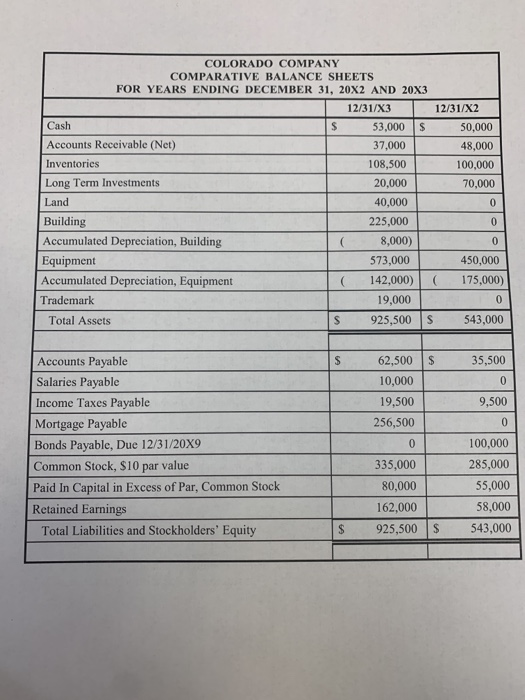

Problem 2 (25 points). The comparative balance sheets for Colorado Company are attached for the years ending December 31. 20X2 and 20X3. The following additional information is available for selected items that occurred during the year ending December 31, 20X3. COLORADO COMPANY ADDITIONAL INFORMATION FOR PREPARING STATEMENT OF CASH FLOWS (1) Investments with a book value of $70,000 were sold at a $4.000 gain. In addition, the company purchased additional investments for cash. (2) Bonds payable were retired at their face amount during the year. No bonds were issued during the year. (3) The company issued 5,000 shares of common stock at S15 per share. In addition, the company paid dividends of $25,000 on common stock during the year. The company acquired a land and building by issuing a mortgage payable in the amount of $265,000. The company made payments on the mortgage during the year. There were no other transactions affecting land or buildings. The company spent $20,000 during the year developing a trademark. There were no other additions or disposals relating to the trademark during the year. (6) Other than the payment of dividends, no other transactions affected retained earnings except for net income. (7) The company sold fully depreciated equipment that originally cost $60,000 for $1.500. All other changes to the equipment account were due to purchases of equipment for cash during the period. There were no other disposals of equipment during the year. (5) REQUIRED: Prepare a statement of cash flows, using the indirect method, in proper form, for the year ending December 31, 20X3. Be sure to include all information required to provide full disclosure on the statement. COLORADO COMPANY COMPARATIVE BALANCE SHEETS FOR YEARS ENDING DECEMBER 31, 20X2 AND 20X3 12/31/X3 12/31/X2 Cash $ 53,000 S 50.000 Accounts Receivable (Net) 37,000 48,000 Inventories 108,500 100,000 Long Term Investments 20,000 70,000 Land 40,000 Building 225,000 Accumulated Depreciation, Building 8,000) Equipment 573,000 450,000 Accumulated Depreciation, Equipment ( 142,000) ( 175,000) Trademark 19,000 0 Total Assets $ 925,500S 543,000 S $ 35,500 62,500 10,000 19,500 256,500 9,500 Accounts Payable Salaries Payable Income Taxes Payable Mortgage Payable Bonds Payable, Due 12/31/20X9 Common Stock, $10 par value Paid In Capital in Excess of Par, Common Stock Retained Earnings Total Liabilities and Stockholders' Equity 0 335,000 80,000 162,000 925,500S 100,000 285,000 55,000 58,000 543,000 S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts