Question: Problem 2: (25 points) The private equity fund RCX is contemplating the acquisition of High Color Performance Coatings from a large conglomerate. It may finance

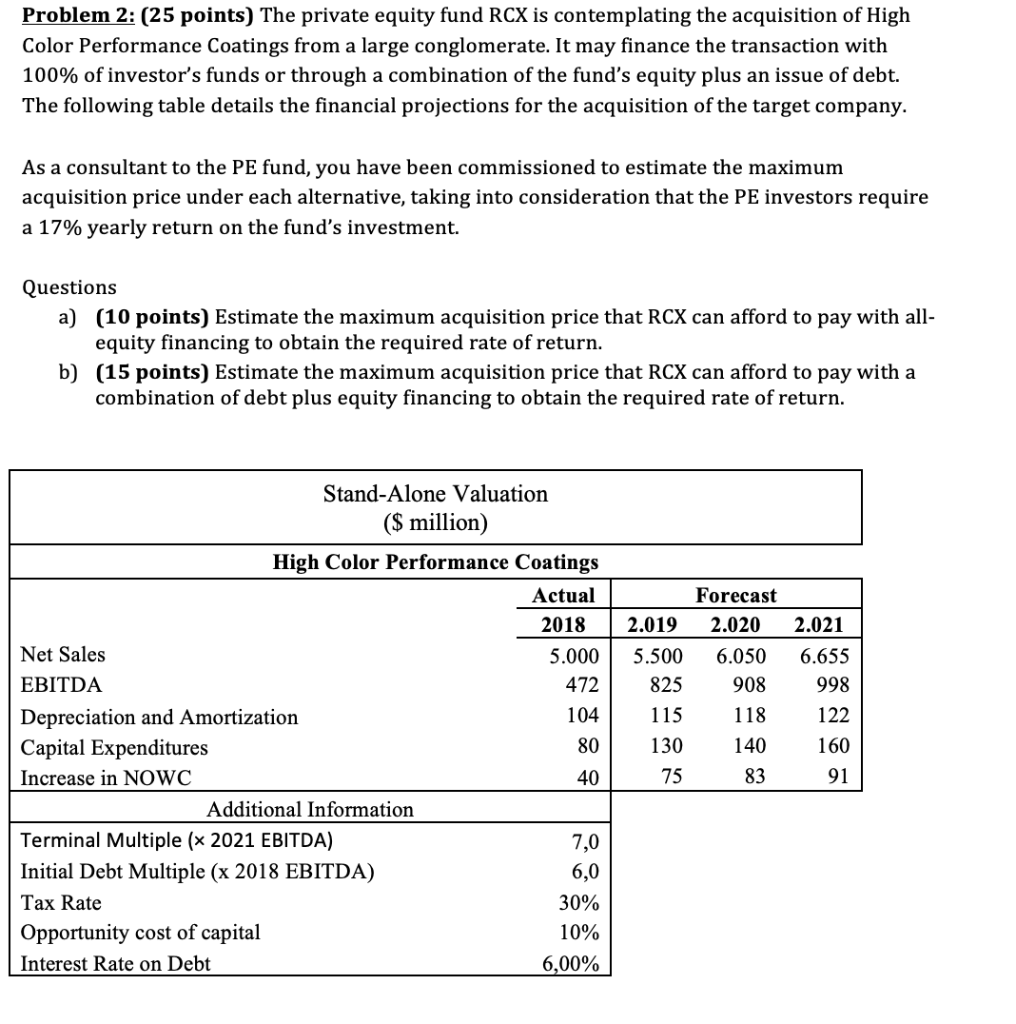

Problem 2: (25 points) The private equity fund RCX is contemplating the acquisition of High Color Performance Coatings from a large conglomerate. It may finance the transaction with 100% of investor's funds or through a combination of the fund's equity plus an issue of debt. The following table details the financial projections for the acquisition of the target company. As a consultant to the PE fund, you have been commissioned to estimate the maximum acquisition price under each alternative, taking into consideration that the PE investors require a 17% yearly return on the fund's investment. Questions a) (10 points) Estimate the maximum acquisition price that RCX can afford to pay with all- equity financing to obtain the required rate of return. b) (15 points) Estimate the maximum acquisition price that RCX can afford to pay with a combination of debt plus equity financing to obtain the required rate of return. Forecast 2.020 Stand-Alone Valuation ($ million) High Color Performance Coatings Actual 2018 Net Sales 5.000 EBITDA 472 Depreciation and Amortization 104 Capital Expenditures 80 Increase in NOWC 40 Additional Information Terminal Multiple (x 2021 EBITDA) 7,0 Initial Debt Multiple (x 2018 EBITDA) 6,0 Tax Rate 30% Opportunity cost of capital 10% Interest Rate on Debt 6,00% 2.019 5.500 825 115 130 6.050 908 118 140 83 2.021 6.655 998 122 160 75 91 Problem 2: (25 points) The private equity fund RCX is contemplating the acquisition of High Color Performance Coatings from a large conglomerate. It may finance the transaction with 100% of investor's funds or through a combination of the fund's equity plus an issue of debt. The following table details the financial projections for the acquisition of the target company. As a consultant to the PE fund, you have been commissioned to estimate the maximum acquisition price under each alternative, taking into consideration that the PE investors require a 17% yearly return on the fund's investment. Questions a) (10 points) Estimate the maximum acquisition price that RCX can afford to pay with all- equity financing to obtain the required rate of return. b) (15 points) Estimate the maximum acquisition price that RCX can afford to pay with a combination of debt plus equity financing to obtain the required rate of return. Forecast 2.020 Stand-Alone Valuation ($ million) High Color Performance Coatings Actual 2018 Net Sales 5.000 EBITDA 472 Depreciation and Amortization 104 Capital Expenditures 80 Increase in NOWC 40 Additional Information Terminal Multiple (x 2021 EBITDA) 7,0 Initial Debt Multiple (x 2018 EBITDA) 6,0 Tax Rate 30% Opportunity cost of capital 10% Interest Rate on Debt 6,00% 2.019 5.500 825 115 130 6.050 908 118 140 83 2.021 6.655 998 122 160 75 91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts